Car repairs under comprehensive insurance with a franchise. In what cases is it better to refuse insurance with a deductible? In what cases should you refuse insurance with a deductible?

When going to an insurance company to insure a car against damage and theft, every car owner should become familiar with the term “deductible,” which insurers love to include in the CASCO agreement. To avoid being misled by marketing and insurance professionals, arm yourself with objective information.

Most often, insurance agents talk about the benefits that the client will receive by agreeing to include a deductible in the policy, but forget to provide it to the policyholder full information about all the nuances that he will encounter. Therefore, you should not blindly trust the words of insurers. Our review will tell you about the pros and cons of the franchise, giving the policyholder the opportunity to make the right choice on their own.

What is a franchise?

The deductible is an amount of money that will not be paid to the policyholder upon the occurrence of an insured event. It can be expressed in absolute value - rubles, dollars, or a percentage of the insured amount under the contract. The deductible, as well as its size, is established in advance in the CASCO insurance policy by agreement between the client and the insurance company.

By agreeing to include a franchise in the contract, the policyholder receives a discount on the cost of the CASCO policy. There are two types of deductible: conditional (non-deductible) and unconditional (deductible).

Conditional (non-deductible) deductible means that all payments exceeding its amount are fully compensated by the insurer, and in this case it is not “deducted” from the amount of insurance compensation. However, if restoration of the car after a minor accident or illegal actions of third parties requires a small amount within the conditional deductible, the insurer will not pay anything to the beneficiary. This means that with a conditional deductible equal to 10,000 rubles, damage that requires up to 10,000 rubles to repair will not be repaired at the expense of the insurance company. At the same time, if the amount of damage is 12,000 rubles, i.e. exceeds 10,000 rubles, insurers will compensate it in full. In fact, this option is almost ideal for the policyholder, but at the same time it is not so beneficial for insurers. Therefore, a conditional deductible is rarely used in car insurance contracts today.

Unconditional (deductible) deductible is always deducted from the payout amount. In any insured event, the beneficiary will receive compensation from the insurer minus the unconditional deductible established in the contract. In other words, an unconditional deductible of 10,000 rubles means that all insurance payments under the policy will be made minus 10,000 rubles each time. It is more often used by insurance companies, since it is more profitable for them than conditional. A deductible deductible is less attractive to unscrupulous policyholders who want to defraud the insurance company.

Before deciding whether to include or refuse a franchise in an insurance contract, you need to understand what practical role it will play for you.

Benefits of insurance with a deductible

Considering that the conditional (non-deductible) deductible has not found wide practical application in CASCO agreements among Russian insurers, it is worth talking about the features of the unconditional (deductible) franchise. As a rule, representatives of insurance companies do not even talk about the type of franchise, using the word “franchise” without any additions, which means an unconditional franchise.

There is no clear answer to the question whether a franchise is beneficial for a car owner. It depends on the specific situation in which the needs, capabilities, driving experience of the policyholder and other nuances play an important role. Depending on them, the deductible can become an advantage or disadvantage of the insurance contract. First, let's find out what positive aspects the unconditional franchise contains.

- Saving on a voluntary car insurance policy. If an unconditional deductible is included in the policy, its cost may significantly decrease for the policyholder. In this case, there is usually a correlation - the higher the deductible, the cheaper the insurance policy (you can estimate the cost of insurance for different deductibles using the online comprehensive insurance calculator). However, by including a deductible in the policy, you should be prepared not to turn to the insurer for payments for minor damage, but in case of serious insured events to receive compensation minus the deductible amount. For example, if the insurance amount under a CASCO agreement is 500,000 rubles, any payment for you will be reduced by 7,500 rubles with a deductible of 1.5%. However, any losses within this amount will not be compensated to you in principle.

- Saving time due to refusal to contact the insurance company for minor insurance events. Concluding an insurance contract with a deductible can be an advantage for those who do not plan to contact the insurance company for every scratch and small chip on the body. Most often, when an insured event occurs, you need to provide the insurance company with a certificate of an accident from the traffic police or a document on illegal actions of third parties from the police department, fill out several applications, and provide the car for inspection by experts. These actions require a lot of time, effort and nerves, especially considering the possibility of standing in queues at each office. By setting a deductible, the policyholder automatically gains time that he would have to spend on paperwork in cases where “the game is not worth the candle.”

In what cases is it worth taking out insurance with a deductible?

Before including an unconditional deductible in the contract, you need to make sure that such a decision will not negate all the benefits of your CASCO insurance. Some drivers should not even think about a franchise, while for others it is a tempting and profitable offer. If, after reading the following points, you understand that they are directly relevant to you, a franchise may be beneficial to you.

- Availability Money for carrying out minor repairs yourself. Having included a small deductible in the CASCO agreement (0.5-2 percent of the cost of the car), the policyholder must be financially prepared to repair the car on their own in case of minor damage. It should be noted that the money saved when purchasing CASCO on a franchise, as a result of the discount received, will be spent on minor repairs. However, according to the theory of probability, the insured event may not occur during the term of the contract. Then the savings on CASCO insurance are obvious.

- Having a long history of accident-free driving and confidence in driving skills. If the policyholder’s driving experience is more than 15-20 years, and he feels at ease behind the wheel, then the deductible established in the CASCO insurance contract will not be superfluous and, most likely, will help save money. The probability of an insured event always exists. However, if the policyholder’s driving style is safe and this has been proven by many years of positive experience, the franchise most often helps to save part of the budget due to a significant discount on CASCO, and at the same time feel protected from thefts and major accidental troubles on the road.

- The desire to insure a car only for the risk of “Theft”. Full CASCO includes two risks: “Damage” and “Theft”. If the policyholder’s plans were initially to purchase a policy against theft only, because he is confident in his driving skills and does not attach importance to minor damage to body parts, then a successful alternative solution would be to issue a full CASCO insurance with a large deductible (7 or more percent of cost of the car) according to the “Damage” risk. It is not possible to insure a car only against theft with all companies, so insurance with a large deductible is a solution if you do not want to change your insurer, but at the same time it does not insure cars only against theft. In addition to protection against theft, a policy with a large deductible will help you receive compensation in the event of total loss (total loss of the car) or major damage as a result of an accident.

In what cases should you refuse insurance with a deductible?

According to the practice of settling insurance claims, the deductible is unprofitable for those who, according to statistics, get into accidents more often than others and contact the company with an application for payment. As a result, the initial savings on the cost of CASCO turns into multiple unforeseen expenses for car repairs. Young drivers and anyone who doesn't feel confident behind the wheel may lose protection with deductible insurance. Those drivers who are just starting their journey behind the wheel of a car often should not apply for CASCO with a franchise. It is safer to pay the full price for the policy to the insurance company, taking into account all increasing factors, and be confident in your insurance protection. As practice shows, minor accidents can happen to inexperienced drivers several times a month. This is especially true for drivers - women and men who received their license after 40 years of age. If there is an increased risk of insured events, it is better to calculate CASCO insurance at the full rate.

So, small unconditional franchise (0.5-2% of the cost of the car)- an ideal option for experienced drivers who, most likely, will not contact the company for minor repairs or believe that it is more profitable to do it themselves to avoid paperwork. Large unconditional deductible (more than 7%) will be useful for policyholders who want to protect their car from theft, total loss or serious damage in an accident. You should not blindly trust the advice of insurance agents about including a deductible in the policy (better read the CASCO rules and

A deductible is a certain part of the damage under CASCO, which the car owner compensates independently upon the occurrence of an insured event.

Often the size of this franchise is a fixed amount of money or a percentage of the cost of the car.

The franchise can be opened in rubles, dollars or euros, as well as as a percentage of the insured amount.

Its size is established strictly in the CASCO insurance policy by agreement of both parties(insurance company and car owner).

If the client agrees to include a franchise in the contract, then The policyholder is given a discount on the cost of the policy.

There are two types of franchise for car owners: unconditional (deductible) and conditional (non-deductible).

Unconditional franchise in CASCO

The most common CASCO insurance deductible is unconditional.

It lies in the fact that the policyholder himself assumes an obligation in the event of an insured event and is ready to independently bear expenses within a certain amount.

The insurance company only reimburses the difference between the cost of damage and the amount of the deductible.

An unconditional franchise is suitable if:

- experienced driver, rarely gets into an accident (maximum once a year), and also leaves his car in a garage or parking lot;

- the deductible amount is less than the deductible discount amount.

With insurance with an unconditional deductible, the car owner can save up to 70% of the policy cost.  Do not forget that if several insurance events occur within a certain period, the payment costs may exceed the amount saved when purchasing a CASCO franchise.

Do not forget that if several insurance events occur within a certain period, the payment costs may exceed the amount saved when purchasing a CASCO franchise.

For example, an unconditional deductible of 11,000 rubles implies that absolutely all payments in the event of an insured accident will be paid minus 11,000 rubles.

This is the most profitable option for insurance companies, but less attractive for those policyholders who are trying to deceive the insurer.

Conditional franchise

A conditional deductible implies that the car owner will be able to receive full compensation for damage from the insurance company, even if this amount exceeds the amount of the conditional deductible.

The policyholder bears the costs provided that these costs for car repairs fall within the amount of the conditional deductible.

In this case, the amount of car insurance is practically not affected by the conditional deductible.

This franchise is rarely used among car owners.

For example, if the deductible is 11,000 rubles, and the damage is estimated at up to 11,000 rubles, then such expenses will not be reimbursed by the insurance company.

However, if the damage amounts to 14,000 rubles, i.e. more than 11,000 rubles, then the insurers are obliged to compensate it in full.

Is it worth insuring your car under CASCO with a deductible?

Before purchasing a CASCO insurance policy and determining its size, it is worth considering the following nuances:

- assess the state of your financial situation in the event of restoration of the car after an insured event;

- take into account the possible amount of material damage after car repairs due to any damage at your dealer (provided that the car is under warranty) or at an unofficial service station (provided that the car is used).

It is necessary to decide on these issues in order to assess the real need to open a CASCO franchise.

For example, if the franchise is open at $500, and subject to repairs at a dealer car service, it will exceed this figure, then CASCO will be meaningless.

It is profitable to open a CASCO franchise under the following conditions:

- Are you an experienced driver? with extensive experience of accident-free driving.

- Do you think that It’s easier to pay for minor damage, How to deal with the procedure for registering an insurance claim.

- Your goal is the lowest cost of CASCO insurance due to the franchise for the “Damage” risk, and the real interest is in the “Theft/Theft” risks.

CASCO with franchise: pros and cons

The conditional franchise is less popular than the unconditional franchise, so the advantages of the deductible (unconditional) franchise are mainly highlighted.

Often, insurance companies do not even distinguish between conditional and unconditional franchises, but offer conditions only for unconditional ones.

It is quite difficult to answer the question whether a franchise is profitable for a car owner.

The benefit will depend on the specific insured event, and the choice depends on the driver’s driving experience, his needs and capabilities.

Such features can be both an advantage and a disadvantage when choosing a car insurance contract.

Among the advantages of the CASCO franchise are:

- a reduction in the cost of a CASCO policy by more than the deductible amount. This advantage is especially noticeable when calculating the cost of a policy for drivers with little experience, since insurance companies usually set higher coefficients for them;

- significant time savings, because for minor insured events, the car owner does not contact the insurance company.

The main disadvantage is that if a minor accident occurs, and the damage from it does not exceed the amount of the deductible, then the owner will repair the car at his own expense and will become a “break-even client,” meaning there is virtually no ability to claim minor losses.

The choice of a CASCO franchise should be based on the real benefits of such insurance for your car.

Analyze all the pros and cons, as well as the need to open a franchise to make the right decision.

When applying for CASCO insurance, every car owner is faced with the concept of “franchise”. What does this mysterious word mean - “free” cheese in a mousetrap or a really profitable offer?

CASCO deductible is the amount of money that, in the event of an insured event, the owner vehicle pays independently. The deductible itself, as well as its size (this is either a clear fixed figure in monetary terms or a percentage of the price of the insured car) is negotiated between the client and a representative of the insurance company in advance before issuing an insurance policy.

![]()

And finally: if you drive carefully, thanks to the franchise you will save a significant amount of money and time.

Car insurance today against the risks of the most different types not a luxury, but a necessity. That is why CASCO policies are in great demand, as they allow you to avoid various types of costs associated with car damage.

The only drawback of this type of policy is its high cost, but it can be significantly reduced due to an unconditional deductible.

What it is

An important feature of the insurance contract is called. It directly affects the cost of the policy. The higher the unconditional deductible, the lower the insurance premium the insured client will have to pay.

An unconditional deductible means a certain amount of money that the insurance client refuses when an insured event occurs.

For example, as a result of an accident there was damage in the amount of 120 thousand rubles. The amount of the unconditional deductible stipulated in the insurance contract was 20 thousand rubles. In this case, the policyholder will receive an amount equal to the difference between these two values - 100 thousand rubles.

The type of franchise in question has a large number of different advantages, which is why it is very popular.

The most important ones include:

- low cost of the policy;

- in the event of minor accidents, the damage from which falls within the deductible amount, no payments are incurred - this has a positive effect on the insurance history.

This type of franchise should be purchased by experienced drivers for whom accident-free driving is the norm.

Such clients, when taking out a CASCO policy with an unconditional deductible, simultaneously kill two birds with one stone: they avoid large expenses on the insurance premium and do not have to worry about death or serious damage to the car.

The size of the franchise of the type in question is determined as:

- some specific amount;

- an amount expressed as a percentage.

It is most profitable to use the specific amount agreed upon in the contract. This allows you to predict your expenses.

The deductible, expressed as a percentage, allows you to further reduce the amount of the insurance premium. But at the same time, it is less profitable in the event of an insured event.

What features does it have?

An important feature of an unconditional franchise is its size. In each individual case, its choice is made individually. The amount of the franchise depends, first of all, on the cost of the car, its individual parts, as well as the complexity of repairs.

For example, there is no point in a franchise whose size is only 1 thousand rub., No. Since to carry out repairs and purchase parts today, most vehicles require a fairly significant amount, usually five figures.

Most often, the minimum unconditional deductible can be an amount of at least 10 thousand rubles. Most often, the amount expressed as a percentage is calculated based on the cost of the car.

The most common ratios are:

- from 0.5% to 2%;

- more than 5.

Accordingly, the higher the percentage, the lower the cost of the CASCO policy.

Another feature of the unconditional franchise is the impossibility of avoiding its use if insured old car(whose age is more than 3-4 years).

Most insurance companies provide CASCO policies only subject to the use of a deductible of 10% for equipment of this type, if the following risks are insured:

- theft/theft;

- complete structural failure.

Also, quite often, the use of an unconditional franchise is mandatory for new cars whose age is less than 3-4 years.

This is necessary if the CASCO policy includes drivers whose age is less than 25 years, or their driving experience does not reach 3 years.

Most often, the deductible is expressed as a percentage of the cost of the car. In most cases, its size is at least 5% - this parameter is greatly influenced by the cost of the insured vehicle.

What does the cost depend on?

The cost of a CASCO policy with an unconditional franchise depends primarily on the following factors:

- age and length of service of the driver;

- the number of persons allowed to drive a car;

- the presence of accidents, compensation payments in the next year or two;

- the presence of an anti-theft system in the car, satellite navigation, and other additional equipment;

- place and conditions of vehicle storage.

Most of all, the price of a CASCO policy with a deductible of the type in question is influenced by the age and experience of drivers admitted to driving.

The shorter the length of service, the higher the cost of the policy and the minimum deductible. This is how the insurance company tries to protect itself from possible losses.

The more people who can drive a car, the less likely it is to drive without an accident. Therefore, the more drivers are included in the policy, the greater the increasing coefficient is used. Many insurance companies allow themselves to double the price of a CASCO policy if the number of persons included in the policy is more than two.

The cost of the policy is greatly influenced by the insurance history. Most companies take into account Last year: whether there are accidents, what is the amount of compensation payments.

The more traffic accidents a driver has, the more CASCO will cost him.

Also, the minimum size of the unconditional franchise will be very large. In some cases, the company may completely refuse to issue a CASCO policy if the client has shown himself to be unreliable and unprofitable. This problem can only be resolved by contacting another insurance company.

The more seriously the car is protected from theft, the lower the cost of insurance. Thus, the presence of an advanced anti-theft system and a satellite tracking system can sometimes reduce the cost of a CASCO policy with an unconditional franchise by almost one and a half times.

The storage conditions of the car are also very important: if it is constantly in paid parking or stored in a garage, then the price of the policy will be minimal. In addition, the risks associated with theft are reduced.

How is it different from conditional

In addition to the unconditional franchise, there is also a conditional franchise. It also has both its advantages and disadvantages. The contract stipulates a certain amount within which the policyholder is responsible for the damage independently.

And only if its amount exceeds a certain amount, an obligation to pay monetary compensation arises.

The most important difference between a conditional franchise and an unconditional franchise is that if an insured event occurs, the company fully covers all damage.

In this case, there are no deductions or other monetary losses on the part of the policyholder. It is worth considering that the conditional deductible has a significantly smaller impact on the price of the CASCO insurance policy.

That is why you should think carefully before choosing one or another way to save money. Each franchise has its own advantages and disadvantages.

Most insurance companies provide CASCO policies on the following conditions:

This makes the unconditional franchise obviously more profitable compared to the conditional one. That is why most car owners choose it when concluding an insurance contract using a CASCO policy.

Which type of CASCO franchise is better to choose?

Today, many insurance companies offer their clients not only an unconditional and conditional franchise, but also some others:

- dynamic;

- preferential

A dynamic deductible involves an increase in insurance compensation in the event of each new insured event.

For example, if no monetary compensation is paid for the first accident, then for the second it covers 50% of the damage, and for the third – 75%. Each insurance company offers different conditions.

A “preferential” franchise means the presence of any conditions under which compensation is not paid or, on the contrary, is paid.

The choice of a particular type depends on large quantity a variety of factors. If the driver has an impressive experience of accident-free driving, then he should turn his attention to the conditional franchise.

Since it allows you to minimize the likelihood of incurring any losses as a result of an accident (in the absence of minor road accidents).

If the driver has little driving experience, then it is best for him to purchase a CASCO policy with an unconditional deductible. Since it will allow you to avoid a “bad” insurance history: the presence of minor accidents will make purchasing a CASCO policy for the next year significantly more expensive.

And at the same time, using a franchise will make it possible to slightly reduce the cost of insurance of the type in question.

The use of a preferential or dynamic franchise is justified only in some individual cases. For example, if the car is used quite rarely and the likelihood of an accident is low due to the seasonality of operation.

Each individual case should be considered separately; it is best to consult with an employee of the insurance company - it is in his interests to reduce the likelihood of the need for an insurance payment. At the same time, this factor can significantly reduce the cost of the policy.

Purchasing a CASCO policy with a deductible allows you to significantly save your money. This is important given the high cost of this type of policy today.

The franchise also makes it possible to avoid the need to collect a lot of documents in the event of a minor traffic accident.

Video: What is CASCO, franchise

The word "franchise" is of foreign origin. Not everyone understands it, however, you need to navigate the topic, because today the deductible is widely used in car insurance. Is this beneficial for car owners? A question that requires some clarification. Let's try to figure out what are the features of a car insurance franchise, its main types, advantages and disadvantages when insuring a car under CASCO. An approximate calculation of the franchise size will help you understand the essence of the subject.

What is a deductible in insurance - we explain in simple words

The activities of insurance companies are inextricably linked with the franchise. It is used in almost any insurance product and car insurance is no exception. Franchise is translated from French as a benefit. If we consider the deductible in relation to insurance, then this is a certain part of the damage that is not compensated by the insurer. This is called the non-reimbursable portion of the damage. All nuances must be specified in the property insurance contract.

To put it simply in simple words, the deductible is part of the insurance payments, which the client voluntarily refuses if an insured event actually occurs. When is the franchise amount determined? When taking out an insurance policy. This may be a specific amount expressed in rubles, or a percentage of the insurance payment. A simple example: a car was damaged in an accident - damage was caused to it, insurance compensation is calculated - the amount of damage is estimated, the deductible is deducted from the total amount of damage. The amount received is paid to the policyholder.

Russians strive to avoid this with all their might. In the understanding of our citizens, this is something superfluous and unnecessary. In fact, this is a real chance to save money. With a small deductible, the damage is fully covered, but in this case the insurance rate will be high. With a large deductible, the opposite is true: incomplete coverage of losses at a lower cost of insurance.

Types of franchises for car insurance - the difference between conditional and unconditional

The deductible for car insurance can be of two main types: conditional and unconditional.

- What does it suggest? conditional franchise ? If the damage caused to the car exceeds the deductible amount, the insurer compensates it in full. If the loss does not exceed the deductible, then the policyholder does not receive any payments from the insurance company. Thus, the car owner is either not compensated for damage at all or is compensated 100%.

- Unconditional franchise assumes that the policyholder always covers a certain part of the loss on his own, that is, part of the damage will not be compensated by the insurer. The amount of compensation will be less due to the deduction of the deductible amount, which can be expressed in two options: have a fixed amount or as a percentage of the damage.

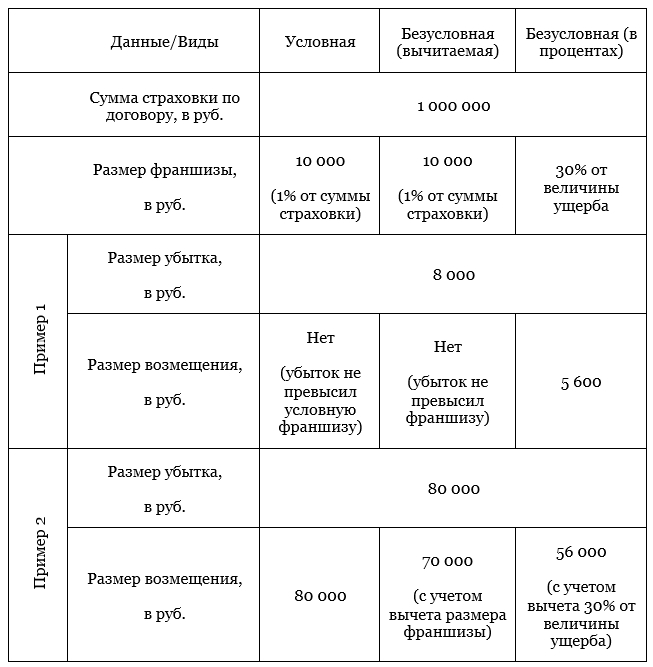

To understand how each type of deductible in insurance is actually applied, a table will help you understand the amount of compensation given the same initial data and the same amount of damage:

New deductible options are appearing in auto insurance. For example, the unconditional view is used in the dynamic version. It takes effect when damage occurs a second time. The contracts indicate that the amount of the deductible increases with the occurrence of each new insured event. It looks something like this:

- In case 1, the dynamic deductible is 0% (full reimbursement).

- At 2nd - 5%.

- At 3rd - 10%.

- At 4th and further - up to 40%.

Another variation is a preferential franchise. There is no exact term yet; the name may vary. What's the point? The contract specifies cases to which the franchise does not apply. Let us assume that it is established that the accident was not the fault of the insured. This means that there will be no deduction for the deductible when calculating payments.

Pros and cons of franchise insurance when insuring a car under CASCO

Car insurance has long been a must for vehicle owners, especially for new or credit cars. CASCO policy is widely used in Russia. This is a convenient insurance product, although it also has its pros and cons, which are constantly discussed in information sources.

The most significant point for this type of insurance is the high cost, which is constantly increasing against the general background of the increasing cost of new cars.

The cost of CASCO insurance for the year is 10% of the price of the car. Agree, a lot of money. That is why car owners began to seriously consider an unconditional CASCO franchise. In this option, the price of the insurance policy will have a significant discount. Here's your advantage. Is this beneficial and what does the car owner “sacrifice”?

Having CASCO insurance, a person expects compensation for any damage caused to the car, the degree of damage does not matter. The insurer will pay anyway. If CASCO insurance is issued taking into account a deductible, then a clearly defined amount is implied that is not paid by the insurer when damage occurs. The policy is cheaper by this amount.

Franchise insurance completely shifts the costs of eliminating minor damage onto the shoulders of the policyholder.

If the damage is large and it exceeds the deductible, then the insurer steps in and pays for the damage.

- Disadvantages of CASCO insurance using a franchise: This type of insurance practically inaccessible for credit cars. The bank is interested in the safety of the collateral, which is a car. However, the guarantee is that the owner will deal with minor damage such as scratches, broken glass

- and other things, no. In addition, when purchasing a car on credit, the cost of CASCO for the entire loan period (3-5 years) is paid by the bank. It is the lender who transfers the cost of the policy to the insurance company,

- This means that registering a franchise is simply impossible. Another drawback - sometimes insurers refuse to pay, citing the fact that the amount of damage does not exceed the deductible . Estimation of loss is a conditional matter, in each service center your criteria. Therefore, often the costs of renovation work

deliberately underestimated by representatives of the insurer. If the owner turns to other specialists, there is a possibility of receiving a larger bill.

It is important for buyers of CASCO insurance with a deductible to understand one nuance.

Small losses that often occur do not affect payments in any way, therefore, they are not recorded in the insurance history, which means that the driver’s driving is considered break-even.

For this reason, the insurer has no reason to increase the cost of the next contract; moreover, a new policy can be purchased at a discount.

How to calculate the deductible for car insurance correctly

To correctly calculate the deductible for car insurance, you need to rely on three parameters specified in the contract. This is the sum insured, the percentage of the deductible and the type of deductible chosen.

- Let's look at an example. Initial data:

- The insurance amount is 1,000,000 rubles.

- The deductible amount is 0.06% of the insurance amount. This means the franchise size is 1,000,000 × 0.06% = 600 rubles.

The deductible amount can be a percentage of the amount of damage, say 20%.

- The calculation of payments will depend on the type of franchise and the amount of damage: Option #1.

- Most often, the unconditional type (deductible) is used, in which the amount of the deductible is subtracted from the amount of damage. Let’s say the damage is estimated at 2,000 rubles. The company will pay the client 1,400 rubles (2,000 - 600). If the damage amounted to 300 rubles, then the policyholder is not entitled to compensation - there is no excess of the deductible.. Unconditional view (percentage). Let’s say the damage is estimated at 2,000 rubles. The company will pay the client 1,600 rubles (2,000 - 20% = 1,600). If the damage amounted to 300 rubles, then the policyholder is entitled to 240 rubles (300 × 20% = 60).

Of course, a third option is also possible - a conditional franchise. However, it is practically not used for car insurance. The reasons are simple and banal. Cases of fraud on the part of policyholders have become more frequent, who tried to increase a small loss “artificially” in order to receive a full payment (100%). This type is considered the most interesting for car owners.