How to close a current account

There are several situations when it is necessary to close a bank account, for example, liquidation of an enterprise, change of ownership, change of servicing bank. In any case, the procedure and conditions for closing an account are described in the agreement on its opening. In accordance with state legislation, account closure is carried out on the initiative of one of the parties to the agreement, i.e. bank or client in as soon as possible(1 day).

To close a current account:- contact the bank branch where the account is opened;

- request a statement of your current account;

- pay off existing debts;

- if there are funds in the account that need to be transferred to another account, then issue a payment order in which you indicate the details of another account, or receive the balance in cash at the cash desk;

- fill out a special application form to close an account (each bank has its own form);

- hand over the application responsible person in a banking institution;

- wait for it to be signed and receive a notification that the account is closed.

If the organization has not notified its counterparties about the closure of the current account, then with each transfer Money to the old account, the bank will return the entire amount to the sender, noting that the account has been closed.

You have registered an enterprise or individual entrepreneur, opened a bank account, birds are chirping in your soul, wings are growing behind your back - great things lie ahead! I understand that I’m playing the role of Baba Yaga, but... Stop! Did you forget to notify about opening an account? Oh, what kind of notification is this and who should you notify? I'll tell you now.

Attention!!! from 05/02/2014 submit a message to the state. organs are no longer needed. You can read more in the article

A message about both opening and closing accounts (settlement, currency, etc.) is sent to the authorities that control the payment of taxes and contributions, that is, to the Federal Tax Service, Pension Fund and Social Insurance Fund within 7 days on the basis of:

- Art. 23 p. 2 p.p. 1 Tax Code of the Russian Federation (for the Federal Tax Service)

- Art. 28 clause 3 of Federal Law No. 212-FZ of July 24, 2009 (for the Pension Fund of the Russian Federation and the Social Insurance Fund)

“How to count these same 7 days - calendar days, working days, starting from what date?” - you ask and you will be right. Sometimes even the tax authorities and funds do not know the correct answer to this question, considering that days are calendar days, and sometimes they start counting from the day the account is opened. But you shouldn’t follow the lead of illiterate inspectors; turn their attention to the primary sources.

To determine the deadlines for submitting to the tax office, let’s look into the “holy of holies” - the Tax Code. It devotes an entire article to defining deadlines. Article 6.1 clause 6 defines: “A period defined in days is calculated in working days, if the period is not specified in calendar days.” As we remember, when specifying a period of 7 days, it is not written anywhere that 7 calendar days. This means that they are definitely not calendar ones, but working ones. Paragraph 2 of the same article determines from what day the calculation of the period begins: “The period begins on the next day after the calendar date or the occurrence of an event (action) that determines its beginning.”

What is the picture in the funds? And it's the same there. Only now we start from Federal Law No. 212-FZ of July 24, 2009. Article 4, paragraph 6 states: “A period defined in days is calculated in working days, if the period is not established in calendar days.” And paragraph 2 of the same article indicates: “The period begins on the next day after the calendar date or the occurrence of an event (action) that determines its beginning.”

So, we can summarize that the notification must be submitted to the Federal Tax Service, the Pension Fund of the Russian Federation, and the Social Insurance Fund within 7 working days, starting from the date following the day the account was opened.

What happens if you are late?

Failure to timely submit any of the notifications may result in a fine. Fines are imposed:

1. To the enterprise.

For each notification submitted late, the fine will be 5 thousand rubles:

- The Federal Tax Service will fine you based on Article 118 clause 1;

- Pension Fund and Social Insurance Fund - on the basis of Art. 46.1 of Law No. 212-FZ.

But this is not enough.

2. On officials.

Alas, the budget will earn extra money on them too: “The world has a thread, the beggar has a shirt” (have you read how the head of the tax department reported? No? Be sure to read! People should know their heroes. So much desire to work tirelessly is developed! And love the soul is tormented by the Motherland, and the leading role of the party is inadvertently remembered, and about the iron Felix, that “without fear and dill,” well, what am I... I’ll move on to that “world” from which “by thread”).

The fine will range from one to two thousand rubles:

- The Federal Tax Service may impose a fine on the basis of Part 1 of Art. 15.4 of the Code Russian Federation on administrative offenses (Administrative Code of the Russian Federation) Part 1 of Art. 15.33 Code of Administrative Offenses of the Russian Federation.

- The FSS and the Pension Fund of the Russian Federation may impose a fine on officials in accordance with Part 1 of Art. 15.33 of the Code of Administrative Offenses of the Russian Federation - in the amount of one to two thousand rubles (both in the Pension Fund of the Russian Federation and in the Social Insurance Fund).

Or maybe they won't be fined?

Sometimes it happens. If, for example, you send a notification by letter and, without much understanding, it is registered. Sometimes they miss it for other reasons. In any case, this is an oversight of the regulatory authority. However, if you were lucky and were not issued a fine, then you have to wait and tremble for another 3 years - this is the statute of limitations, which is determined by:

- Article 113 clause 1 of the Tax Code of the Russian Federation, if you did not inform the Federal Tax Service in a timely manner.

- Article 45, paragraph 1 of Law 212-FZ when submitting late notifications to the Social Insurance Fund and the Pension Fund of the Russian Federation.

However, among other things, there are circumstances when tax authorities meet organizations halfway and put themselves in the position of a taxpayer. These opportunities are named in Article 112, paragraph 1 of the Tax Code of the Russian Federation, I will quote them in full, perhaps someone can take advantage of:

"1. The following are recognized as mitigating circumstances for committing a tax offense:

2.1) difficult financial situation individual brought to justice for committing a tax offense;

3) other circumstances that the court or tax authority considering the case may recognize as mitigating liability.”

But that’s not all, there are circumstances that exclude the taxpayer’s guilt. They can be found in Article 111 of the Tax Code of the Russian Federation - these are circumstances that are most often called force majeure (extraordinary and insurmountable), as well as the inadequate or serious condition of the manager as a result of illness, precluding the opportunity to lead, and violation as a result of the execution of written explanations given by an authorized body (clause 3, clause 1, article 111 of the Tax Code of the Russian Federation), and other circumstances that the court or tax authority will be ready to accept.

The situation is similar with funds.

Circumstances mitigating liability are named in Article 44, paragraph 1 of Law 212-FZ:

"1. The following are recognized as mitigating circumstances for committing an offense:

1) commission of an offense due to a combination of difficult personal or family circumstances;

2) commission of an offense under the influence of threat or coercion or due to financial, official or other dependence;

3) the difficult financial situation of an individual held accountable for committing an offense;

4) other circumstances that the court or the body for control over the payment of insurance premiums considering the case may be recognized as mitigating liability.”

And Article 43 of Law 212-FZ names situations in which liability from the taxpayer for committed offenses is removed; they are similar to tax ones: as a result emergency situations and natural disasters, as a result of the taxpayer’s inadequate or serious condition due to illness, with loss of the ability to manage, as a result of the execution of written explanations given by the control body (Article 43, paragraph 1, paragraph 3), as well as under other circumstances that may be recognized by a court or control body.

Well, if you are hoping to avoid liability for filing a notice at the wrong time, I have listed all the possibilities known to me. Well, for those who still want to submit a notice of opening (closing) an account in a timely manner, being a conscientious taxpayer, but do not know how, I will continue the topic and move on to an exciting issue.

What forms need to be filled out?

- A notification is submitted to the Federal Tax Service in form S-09-1 “Notification about opening (closing) an account ( personal account)", approved. By Order MMV-7-6/362@ dated 06/09/2011 (as amended by Order of the Federal Tax Service dated November 21, 2011 MMV-7-6/362@)

- It is proposed to submit notifications to the Pension Fund and the Social Insurance Fund in the forms recommended by the funds:

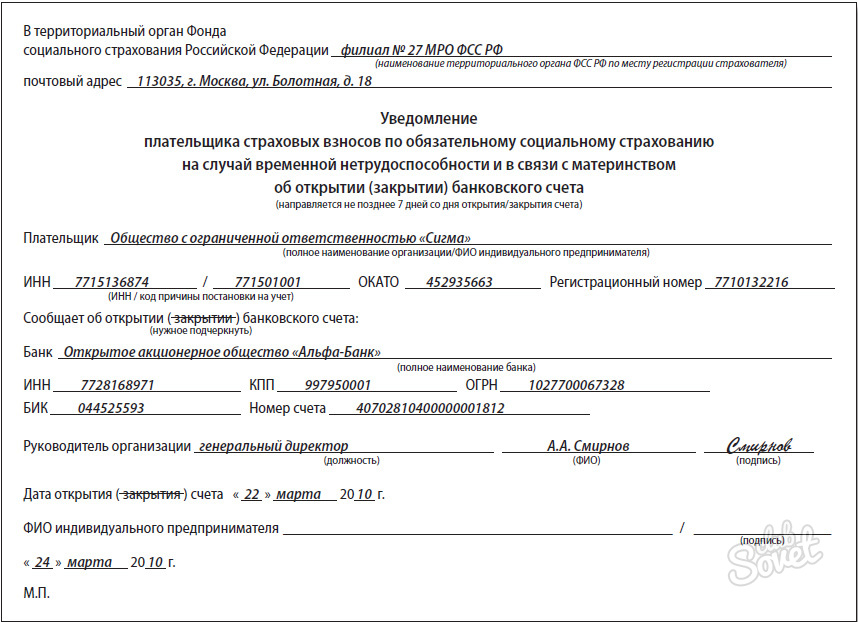

- By letter of the FSS of the Russian Federation dated December 28, 2009 N 02-10/05-13656 The form recommended for policyholders for notification of opening (closing) an account was provided, but, apparently, by mistake only the form for banks was attached. And the recommended one The form for policyholders can be found on the FSS website.

- Recommended Pension Fund forms are posted on its website in the section “Reporting and the procedure for its submission”, subsection “Recommended sample documents”.

Filling out forms

Form C-09-1 “Notification about opening (closing) an account (personal account)”, approved. By Order MMV-7-6/362@ dated 06/09/2011 (as amended by Order of the Federal Tax Service dated November 21, 2011 MMV-7-6/362@).

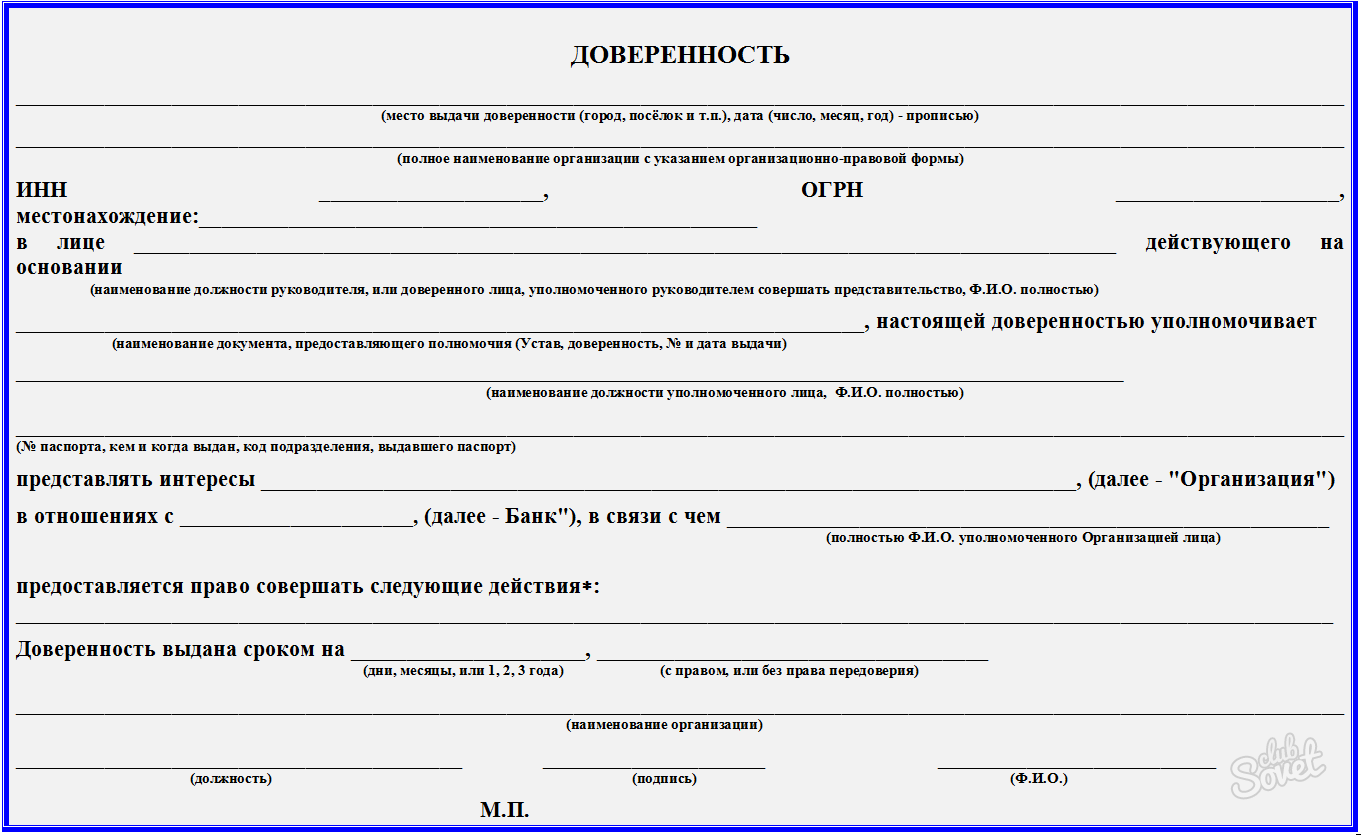

Anyone who has dealt with filling out forms will not find anything difficult there. It is filled out in a standard way, the rules for filling out are the same as for many other forms that we provide to the tax office. For those who don’t know, I’ll break it down: we start filling out any details from left to right, and cross out the remaining empty cells on the right in the middle. If the form is filled out typewritten, empty fields are acceptable, but you should not leave them in the TIN and KPP, cross them out. All data must be filled in capital letters. The name of the organization must be filled in in full, without abbreviations. There are a lot of tips on the form itself, it’s hard to get confused. If the notification is submitted not by an authorized person, but by a proxy, then on the title we indicate at the bottom the name and details of the document (power of attorney) on the basis of which it acts, and where the number of sheets of the application is, you must indicate how many sheets of this document you will attach to the notification. In the block “Reliability and completeness... I confirm”, the full name of the person submitting is entered in all cases, except for code 1 (when the submitter is the entrepreneur named above). When filling out data for a bank branch that does not have its own TIN and BIC, write the TIN and BIC of the main bank through which settlements are made. The data of the bank itself is filled in in accordance with the KGRKO (book of state registrations of a credit organization), the name of the bank is abbreviated. When submitted, the entire form will consist of 2 sheets: a title and a sheet that you will need to fill out. Most often, this is sheet A. Sheet B is filled out for electronic wallets.

If these explanations are not enough for you, use the description of filling out the form for general cases, which is located, or the tax instructions, you can follow the link.

Notifications to the Pension Fund and the Social Insurance Fund

Messages to funds are filled out arbitrarily, the main thing is not to confuse anything with the details, otherwise you can also be subject to penalties, just like for late submission.

Conclusion

Having filled out all the necessary forms, you can take them yourself to the funds and the tax office within the period established by law, or you can send them within the same time frame to in electronic format(with an authorized digital signature) or by mail by a valuable letter with a list of the contents and a notification of delivery (notification is not mandatory, we recommend it as an additional precaution). Mailing will be accepted by the tax office in a controversial situation if you still have a copy of the form itself, an inventory with a mail stamp and a mail receipt for it.

If you liked our site, you can subscribe to our review

POPULAR NEWS

To tax or not to tax – no more questions!

To tax or not to tax – no more questions!

It is not uncommon for an accountant, when paying a certain amount to an employee, to ask the question: is this payment subject to personal income tax and insurance contributions? Is it taken into account for tax purposes?

Tax officials are against changing the procedure for paying personal income tax by employers

Tax officials are against changing the procedure for paying personal income tax by employers

IN last years Information has repeatedly appeared about the development of bills, the authors of which wanted to force employers to pay personal income tax on the income of their employees not at the place of registration of the employer-tax agent, but at the place of residence of each employee. Recently, the Federal Tax Service spoke out sharply against such ideas.

The same invoice can be both paper and electronic

The same invoice can be both paper and electronic

The Tax Service allowed sellers who issued a paper invoice to the buyer not to print a second copy of the document, which they keep, but to store it electronically. But at the same time, it must be signed by a strengthened qualified electronic signature of the manager/chief accountant/authorized persons.

Invoice: the line “state contract identifier” can be left blank

Invoice: the line “state contract identifier” can be left blank

From July 1, 2017, a new line 8 “Identifier of the government contract, agreement (agreement)” appeared in invoices. Naturally, you only need to fill out this information if it is available. Otherwise, this line can simply be left blank.

Based on what document should money be issued on account?

Based on what document should money be issued on account?

The issuance of accountable amounts can be made either on the basis of a written application of the accountable person, or according to an administrative document of the legal entity itself.

Contents of the magazine No. 14 for 2013M.G. Sukhovskaya, lawyer

Late notification of account opening/closing: when there should not be a fine

As you know, when opening or closing settlement (current) ruble and foreign currency accounts, as well as accounts intended for servicing corporate bank cards, you need to report this within 7 working days:

- V Inspectorate of the Federal Tax Service at the location of the organization (place of residence of the entrepreneur) clause 2 art. 23, paragraph 6 of Art. 6.1 Tax Code of the Russian Federation; Resolution of the Presidium of the Supreme Arbitration Court of September 21, 2010 No. 2942/10- according to form No. S-09-1 approved By Order of the Federal Tax Service dated 06/09/2011 No. ММВ-7-6/362@;

- to their branches Pension Fund and Social Insurance Fund clause 1 part 3 art. 28, part 6 art. 4 of Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ) - according to recommended forms Letter of the FSS dated December 28, 2009 No. 02-10/05-13656. Please note that entrepreneurs who are not registered with the social insurance authority as insurers do not have to report their account to the Social Insurance Fund. Part 1 Art. 5 ,.

Let us remind you that there is no need to report deposit, loan and transit currency accounts anywhere. Letters of the Ministry of Finance dated 06/09/2009 No. 03-02-07/1-304; Ministry of Health and Social Development dated May 21, 2010 No. 1274-19. Also, notification is not required if, for reasons beyond the payer’s control, for example during a bank reorganization, bank details (such as correspondent account, BIC) change. The bank itself must inform the tax authorities and funds about this. clause 1 art. 86 Tax Code of the Russian Federation; Part 1 Art. 24 of Law No. 212-FZ.

Recommended forms of notifications to the Pension Fund of Russia regarding the opening (closing) of an account and changes in its details are posted: PFR website→ section “Reporting and the procedure for its submission” → subsection “Recommended document samples”For late notification of account opening/closing and inspection, And each of the funds the organization (entrepreneur) will inevitably be fined 5,000 rubles. clause 1 art. 118 Tax Code of the Russian Federation; Art. 46.1 of Law No. 212-FZ Why is it inevitable? Yes, because the bank in which the account is opened (closed) must also report this “to the right place” clause 1 art. 86 Tax Code of the Russian Federation; Part 1 Art. 24 of Law No. 212-FZ. And, having received a notification from the bank, the inspectorate and funds will immediately see that the owner of the account did not inform about its opening (closing) within the required time frame. They have plenty of time to fine them - 3 years, which are counted from the day following the last day of the period allotted for notification. clause 1 art. 113 Tax Code of the Russian Federation; Part 1 Art. 45 of Law No. 212-FZ.

In addition, a fine of 1000 to 2000 rubles. threatens the head of the company, again from each unnotified body Art. 15.4, part 1 art. 15.33 Code of Administrative Offenses of the Russian Federation. Thus, it is not difficult to calculate that failure to report one account can cost a company 15,000 rubles, and its director - at least 3,000 rubles. True, managers are fined extremely rarely.

But there are situations when there should not be a fine for failure to notify. And if it was nevertheless imposed, then it can easily be challenged.

SITUATION 1. Common. An organization or individual entrepreneur learned late about the opening or closing of an account

Both the Tax Code and the Law on Insurance Contributions state that the 7-day period allocated for reporting an account must be calculated from the day of its opening (closing) clause 2 art. 23 Tax Code of the Russian Federation; clause 1 part 3 art. 28 of Law No. 212-FZ. Such a day is considered the day the bank makes a corresponding entry in the registration book of open accounts in clause 1.3 of the Central Bank Instruction dated September 14, 2006 No. 28-I. But according to its internal rules, the bank must separately notify the client about the opening (closing) of an account and about changing its details in clause 11.1 of the Central Bank Instruction dated September 14, 2006 No. 28-I by sending him the relevant document.

Regarding the notification of the Federal Tax Service about the account of the Supreme Arbitration Court of the Russian Federation, 3 years ago indicated that the 7-day period should be calculated from the moment when the taxpayer received a notification from the bank about opening or closing an account Resolution of the Presidium of the Supreme Arbitration Court of July 20, 2010 No. 3018/10. And the tax service brought this position to the territorial authorities in clause 53 Letter of the Federal Tax Service dated 08/12/2011 No. SA-4-7/13193@. Therefore, lately there have been very few disputes with inspectorates on this matter, because for tax authorities they are obviously losing see, for example, Resolution of the Federal Antimonopoly Service of March 27, 2013 No. A12-21168/2012; 15 AAS dated 02/12/2013 No. 15AP-125/2013.

The courts adhere to a similar position when considering disputes between payers of contributions and extra-budgetary funds - the deadline for reporting an account can not counted earlier than the day when the company or individual entrepreneur received the bank’s notification about opening or closing an account Resolution 13 of the AAS dated May 20, 2013 No. A56-73714/2012; FAS ZSO dated May 29, 2013 No. A27-17198/2012; FAS NWO dated December 17, 2012 No. A42-3000/2012; FAS UO dated 04/09/2013 No. F09-1556/13; 1 AAS dated 02/04/2013 No. A79-9632/2012. Otherwise, the policyholder is not at fault for the offense committed. see, for example, Resolution of the Federal Antimonopoly Service dated 04/03/2013 No. F09-2228/13.

But, judging by numerous arbitration practices, funds stubbornly continue to calculate this period in their own way.

SITUATION 2. Not often, but occurs. The company or individual entrepreneur, having promptly notified the regulatory authorities about the opening or closure of an account, made inaccuracies or typos in the message

For example, they indicated the wrong account number, made a mistake in the name of the bank, its details, etc. In this case, some local inspectorates try to impute failure to provide information about the account. But the courts cool their ardor, pointing out that technical errors and typos made when drawing up a message about an account do not constitute a violation under Art. 118 Tax Code of the Russian Federation. This article does not establish liability for providing false information about an account x Resolution 1 of the AAS dated December 26, 2011 No. A11-4629/2011; 13 AAS dated 03/11/2011 No. A56-52770/2010; 8 AAS dated December 10, 2008 No. A46-14412/2008; FAS NWO dated July 17, 2008 No. A56-54014/2007.

We have not encountered such disputes involving funds. But if such suddenly arise, then the arguments in defense of organizations and entrepreneurs should be similar. Indeed, the Law on Insurance Contributions also establishes a fine only for violating the deadline for notifying funds about opening/closing accounts.

SITUATION 3. Flagrant. Entrepreneur fined twice for failure to report the same invoice

Let us recall that until January 1, 2012, entrepreneurs who did not inform extra-budgetary funds about the opening or closing of business accounts could be fined only on the basis of Part 1 of Art. 15.33 Code of Administrative Offenses of the Russian Federation for 1000-2000 rubles. And even then through the court Part 1 Art. 23.1 Code of Administrative Offenses of the Russian Federation.

Since 2012, the Law on Insurance Contributions for failure to report an account has introduced liability for companies and individual entrepreneurs in the form of a fine of 5,000 rubles, which funds can apply independently. Art. 46.1 of Law No. 212-FZ. At the same time, no one thought to exclude entrepreneurs from the number of persons who can be subject to an administrative fine for the same violation. And it turned out that the individual entrepreneur - as an official and a payer of insurance premiums - is the subject of two identical offenses, liability for the commission of which is provided for by two different legal norms. As a result, the following situation became possible.

The thought that you can avoid a fine, even after going to court, inspires