Accounting: how to prepare a turnover sheet. Synthetic turnover sheet. Example of a turnover sheet

Turnover balance sheet is one of the most important accounting registers, how to draw up a balance sheet, we will consider below. This document displays information about the final and initial balances and movements in financial accounts.

Usually, fill out the balance sheet necessary in the following cases:

Write-off of production costs.

Depreciation calculation.

Formation of financial results.

Calculation of taxes.

Where is the reverse balance sheet used?

Based on the data obtained, balance sheet items are formed. Turnover statements are used to control and systematize the accurate reflection of the facts of economic activity on accounting accounts.Turnover balance sheet forms can be found:

In book or stationery stores, in special departments that are devoted to economic calculations.

Can be downloaded from the financial websites of various companies or at the end of the article.

Create it yourself in Excel (spreadsheets).

In special software systems that are created for accounting, it is possible to draw up a statement, both for a separate account and for general accounts, which simplifies the work of an accountant several times. At the moment, accounting staff rarely agree to fill in the balance sheet by hand. However, this must be done at least once in your practice in order to better understand the principle of double entry and the essence of accounting.

Samples of turnover sheets are often used by students of economics educational institutions for writing term papers and dissertations and solving problems.

Types of balance sheet

There are several types of balance sheet, it all depends on the presentation of information and the object of analysis. Let's take a closer look at them:1. According to synthetic accounts. In order for the compilation to be correct, account turnovers and the opening balance are taken, and then, using calculations, the closing balance is displayed. If such a turnover balance sheet is filled out correctly, it should contain 3 equal totals.

Equality No. 1 – balance of accounts credit and debit. This equality is determined by the fact that the debit balance of synthetic accounts is a reflection of the value of the organization's assets for the initial period, and the credit balance is the size of the sources of all asset inflows.

Equality No. 2 - Equal turnovers on the credit and debit of accounts form the basis of a double entry, while the amount of the operation performed is reflected in the credit of one account and the debit of another.

Equality No. 3 - reflects the value of all liabilities and assets at the end of the period.

If at least one pair of numbers does not converge with each other, then a gross error was made when compiling the addition of revolutions or the register.

2. For an analytical account, the turnover sheet is formed according to various characteristics of a specific account:

This category of accounts does not contain equal turnover, because it represents movement exclusively within one financial account. accounts. The ending and opening balance can be credit or debit, it all depends on whether the account is passive or active.

3. Chess sheet- This is one of the varieties of a reverse synthetic statement. Accountants call this register “checkerboard”, since it is filled out using the transaction log, and accounting accounts are not taken into account in the calculations. This statement also takes into account the equality of results.

Let's look at how the “chessboard” is filled.

1. The checkerboard balance sheet is a table in which there is a horizontal row - these are credit accounts, and a vertical column is a list of debit accounts.

2. The number of columns and rows is equal to the number of accounting accounts used that have a balance at the beginning of the period, according to which cash flows occurred.

3. From the beginning, the opening balance is posted to the accounts.

4. The results for the balance must be summed up by an angle - for credit and debit the amount must be the same.

5. Afterwards, all household amounts are posted. operations. The amount is indicated only once at the intersection of the corresponding current accounts in the tabular part of the register.

6. Then the revolutions are counted per angle.

7. Then the final balance is calculated by arithmetic, all results are summed up.

If the obtained values of credit and debit turnover coincide, it means that the balance has converged. This means that the household data. transactions have been entered correctly, all totals have been calculated correctly, and you can begin to fill out your financial statements. In this case, it will be done perfectly.

Perhaps these are the main points, how to prepare a balance sheet to avoid serious mistakes.

Why is it necessary to fill out a balance sheet? This question worries many ordinary people and officials who are entrusted with such a responsibility.

Despite the fact that the requirements for preparing the paper are not fixed in the current legislation, companies systematically complete it. The fact is that SALT allows you to obtain an objective assessment of the current financial situation in the company at any time. You don't have to wait for reporting to receive information.

Drawing up a balance sheet requires specific knowledge. The manipulation is not difficult, however, during its implementation, maximum care must be taken.

The presence of an error will require a recalculation of the data. The advantage of the statement is the possibility of verification. By checking the final data, the official responsible for drawing up the SALT will be able to immediately verify the correctness of the paper or the presence of inaccuracies.

Today there are several types of paper. They are similar, but have a number of significant differences that you need to familiarize yourself with in advance.

The company has the right to independently develop a statement form or use a ready-made sample. Having chosen the first option, you need to remember the need to include mandatory data in the paper. An analysis of current information on the topic will help identify their list.

Concept Overview

A balance sheet is a document that reflects the state of current accounts at the beginning of a certain period. In addition, the paper records the amount of funds remaining in the account at the end of the period, the amount of income and expenses.

The following types of document are distinguished:

- monthly;

- quarterly;

- annual.

The balance sheet is one of the main accounting documents. The paper reflects all the actions that were performed with the company’s funds for a certain period. The statement cannot be compiled arbitrarily.

To perform the manipulation, all-Russian accounting provisions are applied. In addition, the accounting policies that are followed in the company or region are taken into account.

The balance sheet is created at the time of company registration. During that period, it is considered zero - there are no recorded account turnovers in the document.

When drawing up a document, you need to take into account the following features:

- when the company is registered, its amount authorized capital reflected in 2 documents – debit of account 75 and credit of account 80;

- the company's authorized capital consists of money, fixed assets, goods and materials;

- funds that are reflected in the statement are recorded according to the list of categories;

- Due to the fact that completed transactions are reflected in both debit and credit, any discrepancy in the data indicates an error.

The statement is the basis for entering data into a whole list tax documents. The annual financial report is completed on paper.

Who regulates it?

If you turn to current legislation, it turns out that the term “ turnover balance sheet" V normative legal acts not recorded. This means that the paper is actually used unofficially. In fact, the document is widely distributed. The use of the statement is indirectly based on the provisions of Article 10 of Federal Law No. 402.

The regulatory legal act provides that:

- data that is recorded in primary documents must be registered and accumulated in accounting registers;

- the structure of the register must contain a grouping of accounting objects and the amount of monetary change in each of them;

- register forms for private economic entities are approved by the state, and for those that belong to the country - by budgetary regulations.

It must be remembered that the balance sheet is a primary document. It is used as a . This feature is associated with the legal tradition that arose during the USSR. In addition, on December 28, 2001, the Ministry of Finance of the Russian Federation issued Order No. 119n. The document approved methodological guidelines that related to the accounting of inventories of Russian companies.

If you read the order, it turns out that the turnover sheet is a document intended to record income and expenses. In addition, it reflects the relationship of expenses with the movement of materials and goods in the warehouse and contains balances at the beginning and end of the reporting period.

The balance sheet is very similar to the reverse sheet. However, the first paper does not reflect the consumption and receipt of goods and materials. Due to the presence of such definitions of legal acts and the practice of accounting exchange, balance sheets have become widespread.

The Federal Tax Service often requests them to conduct inspections. So, if you turn to the text of the order of the Federal Tax Service of the Russian Federation No. ММВ-7-15/184, it turns out that the regulations must stipulate the taxpayer’s obligation to provide a balance sheet for monitoring.

Central moments

Features of compilation

To create a turnover sheet, you can use a blank Word form. To do this, you will need to download it for free on the Internet.

There are several types of statements:

- according to analytical account;

- according to synthetic account;

- chess.

The statement can be drawn up only after the account entries have been made.

When the data preparation is completed, you can proceed to filling out the table.

It consists of 2 columns:

- Account number;

- account name;

- balance at the beginning of the month;

- turnover for this month;

- balance at the end of this month.

The last three columns are divided into 2 more columns - debit and credit. In the first column you must enter the account numbers that are used, and in the second - their names. Then the data is entered into the third column. Below you need to immediately calculate the amount of entered data.

The last 2 columns are filled in the same way. The output needs to be checked. To do this, you need to add the data of all columns. If the document was drawn up correctly, the debit and credit results in each column will match in pairs.

Requirements for chess content

The chess sheet is a kind of synthetic one. However, unlike the last paper, the “checkerboard” data is entered using the transaction journal, and not according to accounting accounts. To compose a chess OSV in 2017, you need to follow certain rules.

The document differs from the classical appearance. It consists of horizontal columns in which loan account numbers are entered. There are also vertical columns intended for placing a debit account.

To fill out the document, you must carefully list the account numbers. It is important not to skip data. Next, at the intersection of the columns, you need to post the amounts that correspond to the subaccount numbers. If problems arise with the manipulation, you can use a ready-made example.

The number of horizontal and vertical columns is not limited. It must match total number accounts. When the sheet is completed, you need to calculate the results horizontally and vertically. In this case, the final numbers must coincide.

If the results differ horizontally and vertically, an error was made when filling out the document. The completed table will have to be checked completely. Only then will it be possible to generate a balance sheet.

Types and method

Highlight:

| According to synthetic accounts |

|

| According to analytical account | Data is entered into the document according to account nomenclature, quantitative indicators and categories. The statement reflects the ongoing movement within the account. There is no equality of turns. The account itself can be either credit or debit. |

| Chess | The document is an advanced synthetic statement. It is filled in based on the transaction log. The document is considered completed correctly if equality of indicators is maintained. |

Varieties of documents can be compiled over a year or a shorter period.

Where can I download it?

The form and sample filling can be downloaded on the Internet. Guided by the ready-made material, the accountant will simplify the procedure for preparing the document and minimize the likelihood of making mistakes. The paper form can be downloaded in World or Excel. However, experts recommend filling out the paper in the 1C 8.3 program. Using specialized software will speed up data entry and calculation.

Design rules

There is no form of document that would be mandatory for use everywhere. For this reason, the accountant has the right to draw up the SALT in free form or based on certain templates. Some companies independently develop statement forms, guided by their needs.

However, when drawing up a document, you must follow a number of rules. It should be remembered that the balance sheet is a structured table containing information about economic and financial transactions and various transfers.

For this reason, the document must contain the following information:

- Company name;

- the name of the document itself;

- the period for which the paper is prepared;

- account numbers;

- net profit, expenses and other specific amounts with which transactions are carried out;

- the name of the persons who are responsible for compiling the statement;

- signatures of responsible officials.

An accounting document is drawn up on paper or in in electronic format. If the company uses the second option, the statement must be signed with an electronic signature.

If corrections are made to the document, the dates of the corrections must be included. In addition, it is necessary to indicate the surnames, initials and other details of the persons responsible for the manipulation. Changes must be confirmed by their signatures. Similar requirements are contained in Article 10 of the Law “On Accounting”.

Accounting ledger example

SALT is compiled at the end of each month based on data for each synthetic account. All of them are reflected in the document. A separate line is used to record each account.

It states:

- opening balance;

- loan turnover;

- debit turnover;

- ending balance.

In practice, the movement of funds in a particular month does not always occur. However, the statement in this situation must still be filled out. Instead of the usual set of data, it reflects only the opening and closing balances.

The document must be completed without errors. The accountant who issued the statement must check it.

Carrying out the manipulation, you must be guided by the following rules:

- the result of calculating initial debit balances must coincide with the result of determining similar credit balances;

- the result of debit turnovers must be equal to credit ones;

- the result of determining the final balances must coincide with the final credit balance.

The composition of the paper is based on the use of dual notation. Manipulation allows you to control the correctness of recording business transactions. If there is no equality, an error has been made. The calculations must be done again.

How to check the balance sheet

The check is carried out after the completion of the statement. The totals of balances and turnover for credit and debit must match. It should be remembered that the balances at the end and beginning of the year must be identical.

The formation of a negative or credit balance must be excluded. At the beginning and end of the reporting year, the indicator should not be on accounts 90,91 and 99.

For interconnected accounts, balances and turnovers must correspond. In addition, it is necessary to ensure that the indicators are logical. To perform the check, you need to make a calculation that will confirm the correctness of the data entered.

To avoid mistakes, you must carefully study clause 34 of PBU 4/99. It says that offsetting items of liabilities and assets in the financial statements is prohibited.

However, there are exceptions to the rule. These can be found by reviewing the relevant accounting provisions. The statement is considered completed correctly only if all the rules are followed and the final data agrees.

Synthetic and analytical accounting

Accounts that are intended for a generalized reflection of economic assets and their sources are considered synthetic. This type is used to account for company funds in a single monetary value.

Written recording of a completed transaction is called synthetic accounting. The category includes all accounts that belong to the assets and liabilities of the balance sheet, and are also reflected in the chart of accounts.

Synthetic accounting is used:

- to fill out reports,

- to fill the balance,

- analysis of the financial and economic activities of the company.

To control the safety of valuables, you need to know not only their total value, but also other data necessary for identification. If a company has accumulated debt, along with finding out its total volume, it is necessary to determine the reason for its occurrence.

To perform manipulations of this kind, analytical accounts are used. They allow you to clarify and control the data of synthetic accounts.

Analytical accounts allow you to keep records in both physical and monetary terms. They open in addition to synthetic ones. Recording transactions with category accounts is called analytical accounting. Its implementation is necessary to control and ensure the safety of inventory items.

Carrying out analysis

Analysis of the data contained in the statement allows you to detect errors in accounting information.

When conducting an inspection, you must be guided by the following criteria:

- the active account has only a debit balance;

- passive - only on credit;

- accounts 90.91 should not have a balance at the end of the year;

- accounts 25, 26 do not have a balance at the end of the month.

When studying the completed document, you need to eliminate errors. If inaccuracies are identified, the correctness of the transfer of analytical accounting data for each synthetic account is checked.

Accounting from scratch Andrey Vitalievich Kryukov

Turnover sheet

Turnover sheet

The source information needed to prepare financial statements is now contained in the general ledger. Because main book is large, and there is not enough information in it necessary for drawing up reports, it makes sense for the accountant to do a little preliminary work: write out this information and include it in the turnover sheet.

Turnover sheet is a list of turnover and account balances for a certain period of time.

Turnover sheet with subaccounts

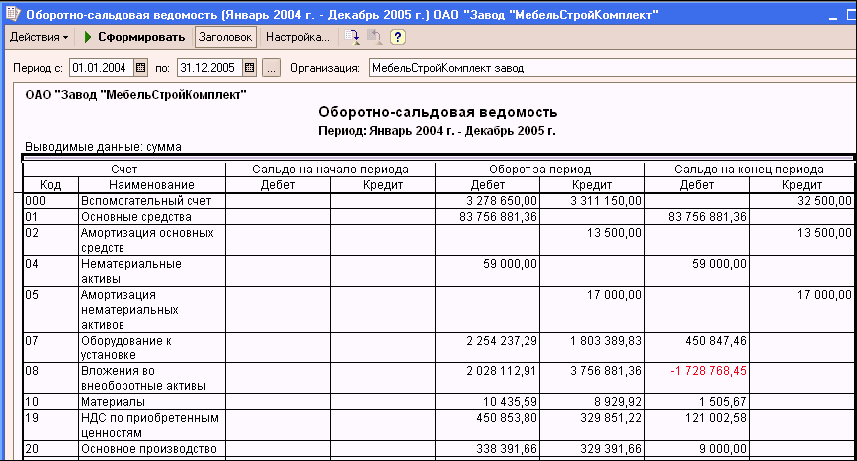

The turnover sheet of the White Daisy organization is presented in the table.

Each row of the table corresponds to the totals for one sheet of the General Ledger. In particular, the turnover sheet line for the account 51 “Current accounts” here corresponds to the General Ledger sheet of account 51, which was shown earlier.

Opening balance – account balance at the beginning of the reporting period. Closing balance – balance at the end of the reporting period.

The totals form three pairs of equal results. This follows from the principle of double entry. The absence of equality in any pair will mean that the turnover sheet is filled out incorrectly.

From the list of accounts involved in the presented turnover sheet, it is clear that the White Daisy organization is a manufacturing enterprise.

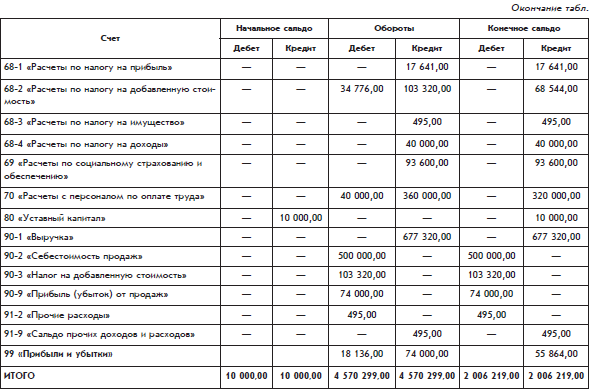

Turnover sheet without subaccounts

The turnover sheet presented above has a small drawback: it does not indicate the total data for accounts that have subaccounts. The relevant information is distributed among sub-accounts.

Information on such accounts can be obtained by simply summing up the data on subaccounts. The results obtained could be included in the turnover sheet in the form of additional lines.

But another option is also possible - to draw up a separate turnover sheet that does not contain subaccounts.

Such a turnover sheet will have a more compact appearance (p. 111–112)

Expanded balance

Let's pay attention to how the final account balance is calculated 60 “Settlements with suppliers and contractors.” This account has two balances: one debit, the other credit. The debit balance of this account (4,600 rubles) is calculated as the sum of the debit balances on the subaccounts of account 60, and the credit balance (559,320 rubles) is calculated as the sum of the credit balances on the subaccounts of account 60.

The debit balance on account 60 represents accounts receivable from suppliers, i.e. the total amount of debts from suppliers of the White Daisy organization. The credit balance on account 60 represents accounts payable, i.e. the total amount of debts of the White Daisy organization to its suppliers.

A double balance calculated using this method is called expanded balance.

Expanded is the balance of an active-liability account that has subaccounts, which consists of two components: a debit and a credit balance.

The debit balance of an account is the sum of all debit balances of subaccounts, i.e., the sum of balances of subaccounts on which balances are debit, and the credit balance of an account is the sum of all credit balances of subaccounts, i.e., the sum of balances of subaccounts on which balances are turned out to be credit.

Please note: in the words debtor, receivables, which seem to come from the word debit, instead of the second letter “e” the letter “i” is written (But: debit balance.), which is explained by the Latin origin of these words. The difference can be seen in the original words: debitum(duty), debet(He must), debtor(debtor). Russian word debit comes from the Latin word debit A Russian worddebtor– from the Latin word debtor Each of these two concepts in Russian has its own derived concepts.

The expanded balance separately shows how much the organization owes and how much the organization itself owes.

For example, according to the account 60 at the end of the turnover sheet period, the organization owes 559,320 rubles, and the organizations owe 4,600 rubles. For the account 60 easy to calculate the usual, rolled up balance as a single number. The amount would be 554,720 rubles. on a loan, that is, as if the organization owes 554,720 rubles, but no one owes the organization anything. But the benefit from the result obtained is small. The calculation of the collapsed balance is, in fact, an artificial offset of debts that are completely unrelated to each other. This calculation smoothes out the real picture of the organization’s financial situation.

In the presented turnover sheet without subaccounts, the final balance turned out to be double, not only in account 60, but also according to the account 62. That is, according to the account 62 at the end of the billing period, there are both debts of the organization to buyers (probably in the form of finished products that buyers have already paid for, but the organization has not yet issued it to them), and debts of buyers of the organization (probably in the form of money that buyers must pay to the organization for already received finished products).

More accurate name turnover sheet - balance sheet, since the turnover sheet contains not only turnovers, but also balances. In addition, the turnover sheet may be called working balance.

Turnover sheet as a source of data for official reports

Once the turnover sheet has been compiled, the accounting department can begin filling out officially approved accounting report forms. They are compiled for the manager and owner, as well as for the state represented by tax office and other interested users.

The main official accounting reports are:

Balance sheet;

Gains and losses report.

From the book 1C: Enterprise in Questions and Answers author Arsentieva Alexandra Evgenievna119. Payroll For accounting payments wages through the cash desk of the organization, a payroll is applied. As a rule, intersettlement payments are also made according to the payroll (payment of financial assistance, temporary disability benefits,

author Vinogradov Alexey Yurievich1.7. Turnover sheet At the end of the reporting period, the data from the accounting accounts is combined. One of the ways of such a combination is the turnover sheet. The turnover sheet is, in fact, the balance sheet of the organization, but in a slightly different form. The turnover sheet is

From the book The ABC of Accounting author Vinogradov Alexey Yurievich

1.8. Chess turnover sheet The possibilities of the turnover sheet are limited. From it it is impossible to understand where the funds came from and where they are directed. This information can be obtained from the chess turnover sheet. Table 1.32. Chess turnover sheet (in thousand rubles)

author Nechitailo Alexey Igorevich

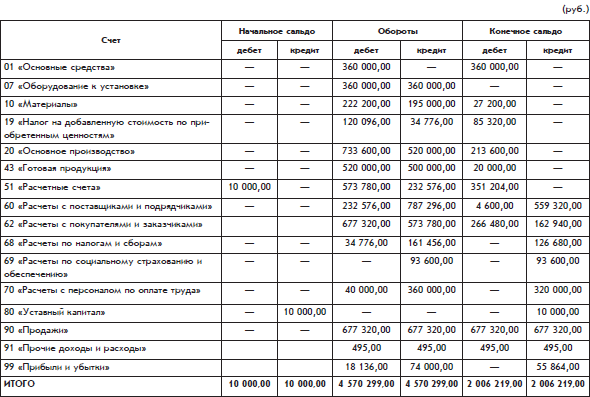

Appendix 1 Statement of analytical accounting of income and expenses by usual types

From the book Accounting and tax accounting of profit author Nechitailo Alexey Igorevich

Appendix 2 Statement of analytical accounting of income and expenses by other types

From the book Accounting and tax accounting of profit author Nechitailo Alexey Igorevich

Appendix 3 Statement of analytical accounting for the formation of the final financial result activities

From the book Accounting and tax accounting of profit author Nechitailo Alexey Igorevich

Appendix 4 Statement of analytical accounting of profit distribution (coverage

From the book Stop Being a Slave to Work! Become the master of your money! author Zyuzginov Alexander

Chapter 11 Balance sheet The balance sheet is the final pivot table your current financial status. Essentially, it is the sixth financial planning tool. And if the Freedom Coefficient shows your current position relative to

From the book 1C: Accounting 8.2. A clear tutorial for beginners author

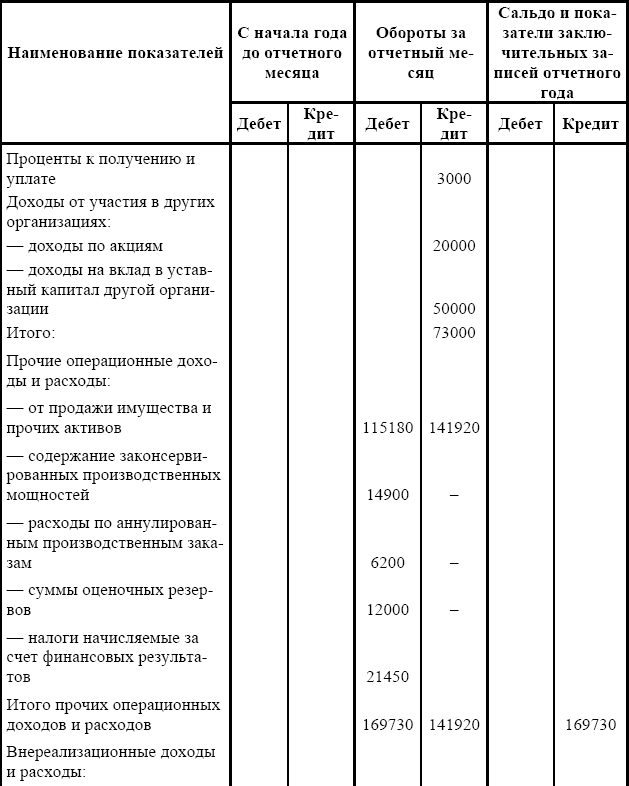

Revolving balance sheet In accounting, two types of revolving balance sheet (hereinafter referred to as SALT) are used: consolidated SALT (for all accounts), and SALT for a specific account. Consolidated SALV contains the incoming and outgoing balances of accounts, as well as turnover for each of them.

From the book 1C: Managing a small company 8.2 from scratch. 100 lessons for beginners author Gladky Alexey AnatolievichLESSON 97. Turnover balance sheet A turnover balance sheet is a report that contains information about turnover and account balances management accounting for the specified time interval. To generate such a report, open the Finance section and in the action panel

From the book The Trap of Globalization [The Attack on Prosperity and Democracy] author Martin Hans-Peter From the book The Practice of Human Resource Management author Armstrong MichaelHR Scorecard The HR Scorecard was developed by Beatty et al (2003) based on the same principles as the balanced scorecard described in Chapter. 2; it emphasizes the need to offer and analyze diverse

From the book Habits in a Million author Ringer RobertThe other side of the coin That meeting with Paul really opened my eyes. From that moment on, I realized how most people, including myself, inevitably make it difficult to make money. I especially remember the part of Paul’s success formula that called for

In order to create a balance sheet, you need to draw up a TSA (turnover balance sheet). It is a form that contains the balances at the beginning and end of the period for calculating the balance; it also includes data on debit and credit for this period for each subaccount. There are reports different types: on analytical, synthetic accounts and chess. SALT can be done only after making entries in the accounts: writing off costs, calculating depreciation, calculating all forms of profit.

So, all the data is prepared, all that remains is to fill out the table, which can be easily downloaded on the Internet. Its header consists of five main columns: account number, its name, “Balance at the beginning of the month”, “Turnover for this month”, “Balance at the end of the current month”. The last three are further divided into subsections: “Debit”, “Credit”.Download directly here on the portal:

Look here for examples:

It is not so difficult to prepare a balance sheet based on transaction data. The main thing is not to make mistakes in the documentation, since SALT has importance for companies and enterprises. Of course, based on the final results of this table, other reports are issued to regulatory organizations. And they, in turn, discover inaccuracies and impose fines, which is a loss for the company.

For each account, write off the cost, add depreciation, and withdraw all types of profit.

This is being compiled accounting document based on a chessboard. Let's assume that some accounts had balances at the beginning of the period. In the columns “Balance at the beginning of the period” and “Balance at the end of the period” there should be only one amount - either debit or credit. Active accounts must have debit balances, passive accounts must have credit balances.

All turnover for the month (representing the sum of both credit and debit transactions) are entered in the appropriate columns. They can be either credit or debit.

Upon completion of filling out the statement, you need to calculate the totals in each column. It is easy to check whether the balance sheet is filled out correctly. The rule of pairwise equality of the totals of all columns must be observed: the debit opening balance is equal to the opening credit balance, debit turnover for the period is equal to credit turnover, ending debit balance is equal to the ending credit balance.

This document is usually compiled using synthetic accounts, but it is quite possible to compile a detailed statement using analytical accounts. The final result of a specific analytical group must be equal to the figure included in the reverse statement into a cell according to this synthetic account.

After a complete check of the balance sheet, the data should be transferred to the balance sheet.

Of course, now most enterprises have computer programs that greatly facilitate the maintenance of accounting records, but the ability to manually fill out balance sheets will help you see full picture movement of funds.

The balance sheet serves, as a rule, for generalization and competent verification of the correctness digital values accounting accounts, as well as to create a new balance sheet. Application this document in the analysis of financial and economic processes is the first step towards automation of analysis, which is based on data from management accounting.

Instruction

Create a table of accounts and enter into it all the amounts for the transactions performed. For each account, enter information about the balances for debit and credit processes at the beginning and end of a certain period.

Number the first column of the table, located vertically, by account numbers. In the second column, write down the name of each account: fixed assets, goods, investments made in non-current assets, sales expenses, current account, cash desk, settlements with suppliers, settlements with accountable persons and employees for salaries, sales and total.

Enter data in the third column of the table for debit and credit balances at the beginning of the month. That is, divide the third column into two parts. One part will contain account information for credit, and the second for debit.

Fill in columns 5 and 6 of the table. Indicate in them the data of turnover for the month made by debit and credit. In turn, in columns 7 and 8 of the table, enter the available data on balances at the end of the month. In this case, also enter information separately for debit and credit transactions.

Account 41 debit "Goods";

- account 60 credit “Settlements with contractors and suppliers”;

- account 42 credit “Trade margin”;

- account 75 credit “Settlements with founders”.

It is possible to include other accounts. In addition, if you set yourself the task of controlling the internal transfer of goods between certain financially responsible entities, then make an entry: 41 credits “Goods”.

Calculate the matrix results. They must contain 3 control equalities:

The sum of the initial (debit) balances of all accounts, which will be equal to the amount of the credit (initial) balances of the same accounts;

- the amount of debit turnover for all accounts, which will be equal to the amount for credit turnover of these accounts;

- the sum of the debit (final) balances of all accounts, which will be equal to the value of the sum of the credit (final) balances of the same accounts.

Video on the topic