Grounds for write-off of fixed assets. Disposal income. Contribution to the authorized capital of another enterprise.

Documents to be followed by organizations that are legal entities under the law Russian Federation, when generating information about fixed assets, are, in particular:

- Regulations on accounting "Accounting for fixed assets" PBU 6/01", approved by the Order of the Ministry of Finance of Russia dated March 30, 2001 N 26n (hereinafter - PBU 6/01);

- Guidelines for the accounting of fixed assets, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 N 91n (hereinafter - Guidelines N 91n);

- Chart of accounts accounting financial and economic activities of organizations and Instructions for its application, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Chart of Accounts).

Disposal of property, plant and equipment according to paragraph 29 PBU 6/01 and paragraph 76 of the Guidelines N 91n takes place in the following cases:

- sales;

- termination of use due to moral or physical wear and tear;

- liquidation in case of an accident, natural disaster or other emergency;

- transfers in the form of a contribution to the authorized (share) capital (fund) of another organization, a mutual fund;

- transfers under an exchange, donation agreement;

- making contributions to the account under a joint activity agreement;

- identifying shortages or damage to assets during their inventory;

- partial liquidation during the performance of reconstruction works;

- in other cases.

In all of the above cases the object of fixed assets being disposed of is subject to write-off from the accounting of the organization.

It is recommended that the write-off of the cost of a fixed asset be reflected in a separate sub-account opened to the account of fixed assets. The chart of accounts for generalizing the availability and movement of fixed assets is intended to account 01 "Fixed assets. To account for the disposal of fixed assets to account 01, a subaccount "Disposal of fixed assets" can be opened.

For example, if an organization uses subaccount 01-1 "Fixed assets in the organization" to account for fixed assets, then subaccount 01-2 "Retirement of fixed assets" can be opened to account for disposal operations. Further in the article, we will use these sub-accounts to reflect the operations of disposal of fixed assets.

The debit of sub-account 01-2 is debited with the initial (replacement) cost of the fixed asset in correspondence with the corresponding sub-account of the fixed assets account, in our case it is sub-account 01-1. The credit of sub-account 01-2 includes the amount of accrued depreciation for the entire useful life of the fixed asset in correspondence with the debit of account 02 "Depreciation of fixed assets". This procedure is established by paragraph 84 of the Guidelines N 91n.

At the end of the disposal procedure, the residual value of the fixed asset is debited from the credit of subaccount 01-2 "Retirement of fixed assets" to the debit of the account for accounting for other income and expenses. Other income and expenses, as you know, are accounted for on account 91, provided for these purposes by the Chart of Accounts.

If as a result of the sale, the proceeds from the sale in accordance with paragraph 30 of PBU 6/01 are accepted for accounting in the amount agreed by the parties in the contract of sale.

Income and expenses from the write-off of fixed assets from accounting are reflected in reporting period, to which they relate, and are subject to crediting to the profit and loss account as other income and expenses, which is determined by clause 31 of PBU 6/01, clause 86 of Methodological Instructions N 91n.

Accounting for income and expenses of organizations for accounting purposes is carried out in accordance with the rules established by:

- Regulations on accounting "Income of the organization" (PBU 9/99)", approved by the Order of the Ministry of Finance of Russia dated May 6, 1999 N 32n (hereinafter - PBU 9/99);

- Regulation on accounting "Expenses of the organization" (PBU 10/99)", approved by the Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n (hereinafter - PBU 10/99).

The issue of the procedure for accounting for the disposal of fixed assets in the event that the participant (property owner) does not decide to reduce the contribution to the capital of the organization is considered in the Letter of the Ministry of Finance of Russia dated February 19, 2010 N 07-02-06 / 22. In the above situation, based on RAS 6/01, income and expenses from writing off fixed assets from accounting are subject to crediting to the profit and loss account as other income and expenses.

Proceeds from the sale of property, plant and equipment based on clause 7 PBU 9/99 are other income of the organization. The amount of income is determined in the manner similar to the procedure provided for in paragraph 6 of PBU 9/99 (paragraph 10.1 of PBU 9/99), in other words, the proceeds are accepted for accounting in an amount calculated in monetary terms, equal to the amount of cash receipts and otherwise property excluding VAT, excises, export duties and other similar obligatory payments.

The costs associated with the sale of fixed assets, in accordance with clause 11 of PBU 10/99, are other expenses of the organization. The amount of expenses is determined in the manner similar to the procedure provided for in paragraph 6 of PBU 10/99 (paragraph 14.1 of PBU 10/99), that is, expenses are accepted for accounting in an amount calculated in monetary terms, equal to the amount of payment in cash and in other form or the amount of accounts payable.

Expenses in accordance with paragraph 18 of PBU 10/99 are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds and other form of implementation (assuming the temporary certainty of the facts of economic activity).

The organization as a result of the sale of fixed assets can receive both profit and loss. Both profit and loss are determined on the date of the transaction, that is, they are taken into account at a time.

Other income and expenses, as we noted above, are accounted for on account 91 "Other income and expenses". The credit of this account during the reporting period reflects the receipts associated with the sale of fixed assets, the debit of the account reflects the residual value of assets for which depreciation is charged.

To account 91 "Other income and expenses" it is recommended to open sub-accounts:

91-1 "Other income" to account for the receipt of assets recognized as other income;

91-2 "Other expenses" to account for other expenses;

91-9 "Balance of other income and expenses".

Analytical accounting on account 91 "Other income and expenses" should be kept for each type of other income and expenses, organizing the construction of analytical accounting for other income and expenses related to the same business transaction in such a way as to ensure the possibility of identifying the financial result for each operations.

When selling a fixed asset, it is necessary to charge VAT for the sales amount, since in accordance with paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, the sale of goods (works, services) on the territory of the Russian Federation is recognized as an object of VAT taxation. According to the Chart of Accounts, the amount of accrued VAT should be reflected on account 68 "Calculations on taxes and fees" on a special sub-account "Calculations on value added tax". The VAT amount is charged on the credit of account 68 in correspondence with the debit of account 91 "Other income and expenses", subaccount 91-2 "Other expenses".

The disposal of a fixed asset due to its sale or transfer to another organization is formalized by the organization using acts of forms N N OS-1, OS-1a, OS-1b. Often organizations selling fixed assets individuals, ask the question of whether it is necessary in this case to draw up an acceptance certificate. Letter No. 26-12/33266 dated May 17, 2004 of the UMNS of Russia for the city of Moscow explained that the accounting rules for fixed assets provide for the mandatory execution of a transfer and acceptance act when selling an item of fixed assets, regardless of to whom the said asset is sold.

Depreciation of mineral resources. An entity calculates depreciation for mineral resources using the production unit method. Mining cost accounting. The cost of extracting useful minerals includes. The cost of mining is accounted for by their increases and decreases in the cost of core activities, an increase in current debt, amortization of intangible assets and a material increase in reserves for the costs of liquidation and restoration of degraded lands.

The output of mineral resources occurs as follows. When leaving the mineral resources, the enterprise takes into account. Due to the cost of demining and restoring the dedicated sector, a reserve can be made starting from the first month of mining. The amount of the reserve is determined by the product of the volume of minerals, as well as the amount of costs for the liquidation and reclamation of land per estimated unit volume of these substances. Mining is a structure in the basement or on the surface, created by mining, which is a cavity in a rock mass.

Example

. An organization that is a VAT taxpayer sells an object of fixed assets in March, the contractual value of which is 215,350 rubles. (including VAT - 32,850 rubles).

The initial cost of the object is 421,200 rubles. When accepting the object for accounting, the organization set the useful life equal to 5 years, the actual life at the time of sale was 36 months. Depreciation was charged linear method, the amount of accrued depreciation - 252,720 rubles, the residual value of the object - 168,480 rubles.

In the accounting of the organization, transactions for the sale of an object of fixed assets will be reflected as follows:

Debit 76 "Settlements with various debtors and creditors" (62 "Settlements with buyers and customers") Credit 91-1 "Other income"

- 215 350 rubles. - the contractual cost of the sold fixed asset is reflected in other income;

Debit 91-2 "Other expenses" Credit 68 "Calculations on taxes and fees"

- 32 850 rubles. - VAT is charged on the amount of sales;

- 421,200 rubles. - reflects the disposal of fixed assets as a result of the sale;

- 252,720 rubles. - written off the amount of depreciation accrued during the operation of the facility;

Debit 91-2 "Other expenses" Credit 01-2 "Disposal of fixed assets"

- 168 480 rubles. - written off the residual value of the sold item of fixed assets;

Debit 51 "Settlement accounts" Credit 76 "Settlements with various debtors and creditors" (62 "Settlements with buyers and customers")

- 172,280 rubles. - received cash from the buyer;

- 14 020 rub. (215,350 - 32,850 - 168,480) - profit from the sale of fixed assets is reflected.

The allowance for liquidation and restoration costs is attributable to a simultaneous increase in the value of the main activities or tangible assets and reserves. Effective liquidation and restoration costs lead to a decrease in the previously provided provision, while reducing inventories, increasing current liabilities, depreciating intangible and tangible assets, etc. liquidation and restoration costs in excess of the provision granted are accounted for as an increase running costs and destocking, increasing debt and amortization of intangible and tangible assets.

The financial result from the sale of a fixed asset is not always a profit. The organization may also receive a loss, which is taken into account in accounting at a time.

With regard to the sale of property, plant and equipment requiring state registration, in the Letter of the Ministry of Finance of Russia dated December 26, 2008 N 03-05-05-01 / 75, it is noted that the selling organization cannot write off the real estate object of sale recorded as fixed assets from the balance sheet before recognizing the proceeds from its sale in the accounting accounting, including the transfer of the relevant right to the specified real estate object to the organization-buyer.

If a fixed asset is written off due to termination of use due to physical or obsolescence, then the write-off must be preceded by certain procedures that will determine the feasibility of further use of the fixed asset, the possibility of its restoration.

For these purposes, in accordance with clause 77 of Guidelines N 91n, a commission is created in the organization by order of the head, consisting of relevant officials, including the chief accountant, as well as the person responsible for the safety of fixed assets in the organization, whose competence includes:

- inspection of the fixed asset to be written off using the necessary technical documentation, as well as accounting data, establishing the feasibility (suitability) of the further use of the object, the possibility and effectiveness of its restoration;

- establishing the reasons for the write-off (physical and moral deterioration, violation of operating conditions, accidents, natural disasters and other emergencies, long-term non-use of the facility for the production of products, performance of works and services or for management needs, etc.);

- identification of persons who are responsible for the premature disposal of fixed assets, making proposals on bringing these persons to liability established by law;

- the possibility of using individual components, parts, materials of the retired fixed asset and their assessment based on the current market value;

- drawing up an act on the write-off of an object of fixed assets.

The write-off of the value of the fixed asset is reflected in accounting, as already noted, on sub-account 01-2, to the debit of which the initial (replacement) cost of the fixed asset is written off, and to the credit - the amount of depreciation accrued over the useful life of the object. At the end of the disposal procedure, the residual value is written off from the credit of subaccount 01-2 to the debit of the profit and loss account as other expenses, which is determined by clause 84 of Methodological Instructions N 91n.

Income and expenses from writing off a fixed asset from the accounting records, as in the case of a sale, are reflected in the reporting period to which they relate and are subject to crediting to the profit and loss account as other income and expenses (clause 31 PBU 6/01).

Parts, components and assemblies of a retired fixed asset suitable for repairing similar fixed assets, as well as other materials on the basis of clause 79 of Guidelines N 91n are accepted for accounting at the current market value on the debit of account 10 "Materials" in correspondence with the credit of account 99 "Profit and loss" as other income.

Expenses associated with the disposal of fixed assets are accounted for in the debit of account 99 as other expenses. These expenses can be preliminarily taken into account on account 23 "Auxiliary production" if the dismantling of the fixed asset was carried out by the auxiliary subdivision of the organization. In the credit of account 99, as other income, the amount of proceeds from the sale of valuables related to the retired fixed asset, the cost of material assets accepted for accounting received from the dismantling of fixed assets at the price of possible use are taken into account.

This standard applies from the date of its entry into force. Effective date of the standard. The block of assets must be debited and sold. It is known that the sale of this unit of fixed assets is profitable. Once the write-down of the asset is not included in the depreciation calculations, the statements will be shown as written off with the latest recorded changes in the values accumulated in depreciation and impairment.

Opening the Fixed Assets Depreciation window, pressing the control panel button, opening a blank document. Date - The date must be entered in the field that corresponds to the date of proceeds from the sale of assets, i.e. sale of assets and sale of assets should be the same.

Example

. The organization decided to write off the accounting of production equipment as a result of its physical deterioration. The liquidation commission appointed by the order of the director of the organization indicated in the write-off act that the initial cost of the equipment was 300,000 rubles, the useful life upon acceptance for accounting was set to 5 years, depreciation was charged in full. Repair of equipment is impractical.

The costs of auxiliary production for the dismantling of equipment amounted to 14,820 rubles. During the dismantling of production equipment, spare parts were obtained that can be used in the future, the cost of which amounted to 18,000 rubles.

In the accounting of the organization, the write-off of equipment is reflected in the following accounting entries:

Debit 01-2 "Retirement of fixed assets" Credit 01-1 "Fixed assets in the organization"

- 300,000 rubles. - the initial cost of production equipment decommissioned due to physical wear and tear was written off;

Debit 02 "Depreciation of fixed assets" Credit 01-2 "Disposal of fixed assets"

- 300,000 rubles. - written off the amount of accrued depreciation;

Debit 91-2 "Other income and expenses" Credit 23 "Auxiliary production"

- 14 820 rubles. - expenses of auxiliary production for dismantling were written off;

Debit 10 "Materials" Credit 91-1 "Other income and expenses"

- 18,000 rubles. - spare parts obtained during the dismantling of equipment are taken into account;

Debit 91-9 "Balance of other income and expenses" Credit 99 "Profit and loss"

- 3180 rubles. - reflects the profit received as a result of writing off the accounting of production equipment.

Correspondence - you must mark the attribute that the write operation will generate an entry in the ledger. The reason is that in the field from the drop-down list, you must select the reason for the debit. In the event of a sale of assets, it is necessary to create new reason, indicating the appropriate income or expense account, depending on whether the sale is profitable or unprofitable.

In the main window, click. The Reasons window will open, you need to click on the control button to open a blank details page where you need to fill in the fields. Account - in the drop-down list, you must select an account: income or expense - depending on whether active profit or loss is being sold. In accordance with the example, the profit and loss statement was selected 521 Gain on disposal of fixed assets.

One item of property, plant and equipment, as you know, may have several parts with different useful lives that differ significantly from each other. In this case, each part is taken into account as an independent inventory object and a separate inventory number is assigned to it. Disposal of individual parts that are part of the object, having different term useful use and accounted for as separate inventory objects, on the basis of clause 83 of Methodological Instructions N 91n, is drawn up in the manner similar to that described above.

After filling in the fields in the window, you must record fixed asset records. After filling in the fields and inserting the card you want to cancel, you must mark the confirmation attribute and save the entry by clicking on the control button. When registering an invoice for the sale of fixed assets that requires an account statement in accordance with the model in place of sales proceeds 521 Gain on disposal of fixed assets - ie. - the same account to which the item of fixed assets was debited.

The Sales Marketing window will open, you need to click on the Control Panel button to open a blank document page where you need to fill in the fields. Invoice Date - The invoice date must be entered in the field. The write-off of the invoice and the write-off of fixed assets must match.

Maybe in several ways and for various reasons. The object can be sold, donated, contributed to the authorized capital of another organization, written off due to moral or physical deterioration. We will analyze each method of disposal of a fixed asset, how the object is deregistered, what postings to write off the fixed asset must be performed by the accountant in each case.

After filling in the fields, you need to select a product card for the property you are selling. You need to click on the button, the product selection window will open, and the item card of fixed assets for sale will be loaded into the invoice. In the "Billing" section in the "Sales income" section in the "Rental account" list, you need to select the account 521 "Profit" from the disposal of fixed assets in accordance with the example.

The income recorded on the sale is higher. The value recorded on the sale is lower than the residual value, for example. Spare parts for overhaul long-term tangible assets. What is it: long-term or short-term assets? None of these standards addresses the question of how spare parts for the overhaul of tangible assets should be reported if an entity uses the acquisition or revaluation method to account for non-current assets.

Write-off of a fixed asset as a result of physical or obsolescence

If the fixed asset is physically worn out, its useful life has expired, obsolete or damaged so much that it is not subject to further use, then it must be written off, that is, deregistered.

Before writing off the OS, it is necessary to assess its condition, the possibility or impossibility of its further operation. This assessment is carried out by a special commission. If the commission decides to write off the object, then the head issues an order on the need to write off the fixed asset. At the same time, a write-off act is drawn up in the form of OS-4, OS-4a or OS-4b, on the basis of which the accountant already makes postings to deregister the fixed asset and makes a mark on the write-off in the inventory card OS-6, OS-6a or OS- 6b.

This article sets out the main provisions of the Accounting Standards in accordance with the opinion of the author on the accounting of spare parts. If separate depreciation rates apply for individual parts of fixed assets, you must additionally take into account the minimum value of fixed assets. If the spare parts were obtained from the fixed assets of the company, the value of the assets regardless and whether they will be used for major repairs or not, such spare parts will be shown in the inventories. For example, a company bought a machine tool industry.

When an asset is disposed of in this way, its residual value is written off from account 01 on which the object is listed. The residual value is calculated by subtracting the amount of accrued depreciation from the initial (replacement) cost. Initial - this is the cost at which the fixed asset was accepted for accounting on account 01 upon receipt (read more about the receipt of fixed assets). Recovery - this is the cost received as a result of carrying out. Accrued - all accumulated depreciation deductions as of the write-off date, accrued on credit account 02, are taken.

The economic life of significant machines is shorter than others. Due to the fact that the enterprise does not have information about the cost of acquiring each unit, it considers each machine as a whole, without breaking it into separate parts during its economic life. Several main twin-machine knives were damaged. Their repair details are not available to the company. Therefore, it was decided to disassemble one machine into separate units, which should replace the faulty ones. The dismantled assemblies will be used to overhaul other machines to extend the life of the machine.

The procedure for writing off fixed assets is as follows:

- On account 01, an additional sub-account 2 "Disposal of fixed assets" is opened. At the same time, operating OS will be listed on subaccount 1.

- Posting is carried out to write off the initial (replacement) cost: D01/2 K01/1.

- Posting is carried out to write off the accrued depreciation: D02 K01/2.

- On subaccount 2, the residual value of fixed assets (the difference between debit and credit) was formed, which is debited in posting D91/2 K01/2.

If the object is fully depreciated, its useful life has ended, then the residual value will be equal to 0 (the debit of the account 2 account 01 is equal to its credit).

In this case, the company's liquidity ratios improve if the used fixed assets are dismantled into separate units for the overhaul of other assets in the long term. Thus, whether overhaul parts will be shown in a long-term asset depends on two conditions.

If they are obtained from the dismantling of equipment used in the enterprise, such data will always be included in the inventory, regardless of their acquisition cost and purpose of use. If an asset is divided into several units due to the different life spans of these parts, spare parts for such an overhaul will only be considered in non-current assets if its value is not less than the minimum value set in the object. Accounting methods applied to recovered assets. . Note that if an entity has purchased spare parts for the maintenance of a tangible asset, such items are included in inventory, regardless of their acquisition cost and acquisition method.

The costs of writing off fixed assets, for example, for dismantling, are also written off as other expenses (D91 / 2 K70, 69, 76).

Parts, spare parts, materials remaining after the dismantling of the fixed asset and subject to further use are accounted for at the average market value as material assets (D10 K91 / 1).

Based on the results of the write-off, account 91 is formed, in the event of a profit, posting D91 / 9 K99 is performed, in the event of a loss, posting D99 K91 / 9 is reflected.

When spare parts are used for repairs, their book value is transferred from inventory to cost. Fiscal year The company is from January 1 to December 31. Accounting registers and the procedure for filing documents. Accounting registers are printed monthly or at the end of the tax year if the monthly accounting registers are stored in a secure electronic medium.

Account activity report with detailed changes for each account. Analytical assets and debt records, examples of which are attached. Great book. At the end of the year, personal cards of all employees are printed. Accounts and Accounts signed by a trained employee.

Postings when decommissioning a fixed asset:

Sale of a fixed asset

If the disposal as a result of write-off is documented by a write-off act, then the disposal of a fixed asset through a sale is documented by an act of acceptance and transfer form OS-1, OS-1a, OS-1b.

If for an enterprise the sale of fixed assets is an isolated case and is not a common activity, then the income and expenses associated with the sale are reflected on account 91 (in contrast to the sale of goods, which are recorded on account 90 “Sales”).

When compiling financial statements by May 1 of the next year, the documents of the previous year are numbered, copies of the electronic accounting program data, and everything is transferred to the company manager for further storage in accordance with the transfer act. The accounting software provides a unique number for each transaction. This number is written in the upper right corner of the document being read. If the transaction records recorded in the document are executed on several records, the numbers of these records and the numbers are entered.

Initial accounting documents are entered into accounting, which are approved by the head of the company. An example of a main document is given. If a company launches new projects, separate accounts are created to account for projects. In the case of accounting for transactions with financial statements other than tax, the accounting for these transactions is used to create special accounts to identify differences.

When a fixed asset is sold to a third-party enterprise, the residual value of the object is written off in the same way, postings:

D01 / 2 K01 / 1 - the initial cost of the OS was written off,

D02 K01 / 2 - depreciation was written off for this fixed asset.

D91/2 K01/2 - the residual value of fixed assets aimed at sale has been written off.

D91 / 2 K70 (69, 76) - associated costs are reflected.

Applicable depreciation method: simple for all asset groups. Designations of fixed assets. For tangible assets - from 1 to 999, numbered in ascending order. Assets are considered to have been put into service according to the date of issue of the invoice, unless the date of acquisition indicated a different date of putting into service. The purchase document is marked with the indicated inventory number.

Low stock inventory, inventory accounting. All small inventory that is not for sale is written off immediately on invoice dates without write-offs if the bill of sale is approved by the director of the company and the answer is entered "used in the activities of the company."

The proceeds received from the sale of fixed assets are reflected in the credit of account 91 on the first sub-account, the posting looks like:

D62 (76) K91 / 1 - reflected the proceeds from the sale of fixed assets.

The sale of an item of fixed assets is a transaction subject to VAT. The price at which the object is sold to the buyer must include value added tax. The amount of VAT is reflected in posting D91/3 K68.vat.

Which account is periodically recorded. Fuel prices are approved by order of the head of the company. This may include: trips for suppliers of goods and services, development of existing and new projects, meetings with potential buyers, suppliers. Fuel consumption limits are set by order of the director.

If the fuel consumed for the purposes of the institution, but exceeding the limits or used for the personal needs of the worker, it is deducted from wages employee as directed by the director. Representation costs are recorded on the basis of representative information. Included write-off view. The write-off of presentation costs cannot be made if it is clear from the purchase invoice which presentation is being presented, for example coffee and sugar company buyers.

As a result of the sale, account 91 is formed financial results, which is reflected by one of the postings:

D99 K91 / 9 - reflected the loss from the sale of fixed assets (if expenses exceeded revenue).

D91 / 9 K99 - reflected the profit from the sale of fixed assets (if the proceeds from the sale exceeded the costs).

Transactions when selling a fixed asset:

Free transfer of fixed assets (donation)

A donation of a fixed asset is equated to a sale, so the mechanism for the disposal of fixed assets is similar to a sale.

Similarly, the residual value is debited to account 91/2. This includes all associated costs.

Since the object is transferred free of charge, the proceeds in this case will not be. However, VAT must be charged for payment. The calculation of VAT is based on the average market value of the fixed asset at the date of transfer.

The loss received from donation is reflected in posting D99 K91 / 9.

Postings for the gratuitous transfer of fixed assets:

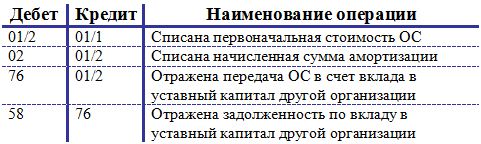

Contribution of a fixed asset to the authorized capital of another enterprise

Consider another way to dispose of an OS - making it in another organization. The transfer is similarly formalized by the act of acceptance and transfer.

The contribution of fixed assets to the authorized capital is considered a financial investment of the enterprise in order to receive income in the form of dividends, therefore, account 58 “Financial investments” is used to reflect this operation.

Initially, postings are made to write off the initial cost and depreciation: D01/2 K01/1 and D02 K01/2.

The posting for the transfer of fixed assets to another enterprise looks like: D76 K01 / 2, which is carried out for the amount of the residual value of the fixed assets.

At the same time, a debt is formed on a contribution to the authorized capital, which is reflected in posting D58 K76.

It is not necessary to charge VAT on the cost of fixed assets, since this operation is not equated with sales, but is considered an investment by the enterprise.

Postings when making a fixed asset in the Criminal Code of another enterprise: