How to check alcohol by code. Special focus on excise

When buying alcohol in a store, few ordinary consumers pay attention to the protective excise tax. But the excise stamp for alcohol is often a guarantee of the purchase of a quality drink (provided that the brand is genuine). If the bottle is pasted over with a fake excise tax (package), then the likelihood of buying burnt alcohol is too high, which can lead to a disastrous outcome, even death. In how to check alcohol on an excise stamp and insure yourself against possible poisoning, we understand the material below.

Basic rules for buying quality alcohol

To avoid buying a "palenki" that is falsely protected by a fake excise tax, you must follow a number of specific recommendations:

- Choose the right place to buy. Avoid small shops (unless they are branded), underground stalls, etc. It is best to buy alcohol in specialized markets or in large large chain stores. There, the likelihood that the network will distribute counterfeit liquor is negligible.

- Look at the cost. Good alcohol can't be cheap. If you are trying to buy a famous cognac at a discounted price, something is probably wrong here. There is a fake.

- Pay attention to appearance bottles. A high-quality drink is poured into a good bottle that does not have irregularities in the molding. In addition, a quality bottle may have various notches, threads, etc. Carefully inspect the cap/cork for strength and durability. The drink must not leak, and the lid/cork itself must not turn or be poorly wrapped.

- Look at the label. As a rule, the label of the drink is printed on good paper with the exact location of the letters. The paint is not smeared, and there is a holographic mark of the manufacturer on the paper. At the same time, information about the manufacturer (legal address and production address) must be indicated on the label on the back of the bottle in small but clear print, and there must also be links to all legal documents of the manufacturer.

Special focus on excise

It is worth knowing that checking alcohol on an excise stamp is the most the right way determine the authenticity of the drink. Since large manufacturers do not save on parcels. Underground workers also significantly reduce excise costs by using counterfeit stamps.

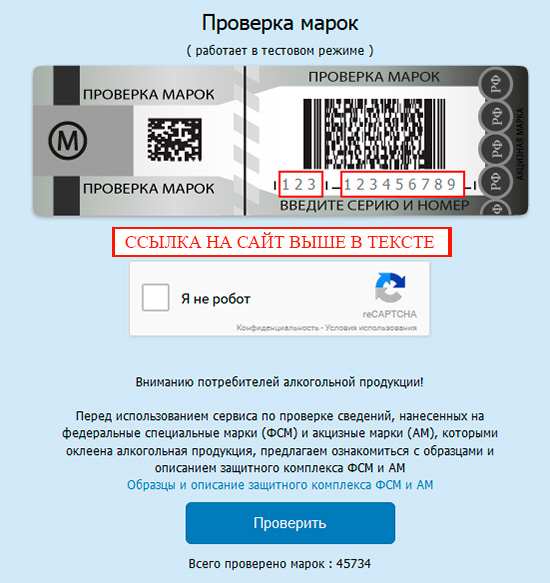

Important: in order to independently check the authenticity of the purchased goods at home, you can use a special information register of the Unified Social Portal of the Russian Alcohol Market or, in other words, through the Unified State Automated Information Service. Here it will be enough to enter numbers with excise stamp(codes) in the site field and information about the drink will appear on the screen of the automated<системы. Соответствие купленного товара и полученного результата говорит о подлинности алкоголя.

Excise by color and type of alcohol

If you do not know how to distinguish alcohol from fake, then, firstly, the excise stamp on a bottle of alcohol can be identified by color. That is, each specific type of drink has a package of a certain color, and a deviation from the norm indicates the inauthenticity of the drink. In particular, the hierarchy of colors by type of alcohol is as follows:

- Alcoholic drinks with a strength of 25% or more have an orange-pink brand;

- Drinks with an alcohol content of 9-25% (except for wine) are marked with a gray-red excise tax;

- Wine has a yellow-green excise tax;

- Champagne and sparkling wines are pasted over with an excise tax of yellow-blue color;

- Wines with a strength of 15-22% have a lilac-green marking color.

We determine the quality of the excise in the store

It is worth knowing that in order to avoid fakes, the parcel, as well as a banknote, is printed on special paper with several degrees of protection. At the same time, visually, the excise tax must be perfectly even and glued strictly in a single plane.

Important: if a bottle with a drink is stored for a long time on the shelves of a store, and before that it was stored in a warehouse, then the brand may somewhat lose its original appearance, but the protective signs do not disappear anywhere.

Tip: The easiest way to verify the authenticity of the excise is to use a special scanner, which is available in every major store. The buyer has the right to ask the administration of the market to use this scanner and identify the authenticity of alcoholic beverages or their fake by number, if he doubts the quality and authenticity of the drink.

Visually, the differences between excise parcels can be determined by the following features:

- Number clarity. You can check the excise with the number and determine the fake through the information resource of excise stamps.

- Persistence and clarity of paint and symbols. That is, when touching the excise tax, the paint is not erased and does not remain on the fingers. And all the characters are printed clearly and evenly.

- Excise Geometry. The state stamp must be perfectly rectangular, without torn edges or cuts.

- Printing on the reverse side of the excise tax. It is worth knowing here that the RF letters are always applied with brown paint on the reverse side of the stamp. In this case, the brand is indicated by the inscription "alcoholic products". The inscription must be fluorescent.

- Yellow staining of the excise. So, if you process the brand paper with a special indicator "C2", then the excise tax will turn yellow.

- Microtext. The upper part of the parcel code contains a special microtext that can be viewed with 100% vision. So, in a negative image (that is, in a mirror image), the word “brand” is printed, and in a positive format, the abbreviation FSM is applied.

- Hologram image. Let's take a look at the hologram. In general, it should be a complex geometric pattern, and on the code in its center, the letters RF are located in rhombuses.

- Gold stripe on parcels. It should not just be painted on excise paper, but woven into the paper in the form of threads. At the same time, such a feature is clearly visible on a quality brand. Sometimes you can even pull on the thread, and it will give.

Resolution of disputes

If it happened that, despite all the knowledge about the excise tax, you suspect the poor quality of the product, then in order to make justified claims, you can go the following ways:

- Contact one of the accredited laboratories of the city and take the drink there for analysis. At the same time, it is important to pay attention that the laboratory is accredited according to one of the systems (GOST R, SAAL and Rospotrebnadzor). This will testify to the competence of the laboratory and the validity of the results obtained.

Important: the costs of conducting an examination regarding an alcoholic beverage, if desired, are borne by the buyer himself. In the future, if the low quality of the drink is proven in court, the manufacturer or those responsible for the sale of low-quality goods are obliged to reimburse the consumer for all costs incurred. And the administrative punishment (fine) incurred will wean lovers counterfeit goods work in a similar way.

- Take the low-quality product and the receipt for its purchase to the point of sale where the alcohol was purchased.

- Submit a letter of complaint to the City Department of Commerce.

- File a complaint with the CPS.

- Write a statement to the district police department at the outlet that sold you low-quality alcohol. As a result, anyone who counterfeits alcohol should be punished accordingly.

Important: in all letters/applications, it is necessary to indicate all the data on the drink and the purchase of alcohol (name, manufacturer, date and place of the alcohol spill, date and place of purchase). In this case, it is important to attach checks (copies of checks), a photo of the drink. Officials MUST respond to the application/letter within 30 days and provide you with a written response.

Smartphone owners can check the legality of alcohol in shops, cafes and restaurants.

As stated on the website of the "Be mobile" project, the federal service "Rosalkogolregulirovanie" has released the Anti-Counterfeit Alco application for devices running on Android, iOS and Windows Phone. The program will allow you to verify the authenticity of information on federal special stamps and excise stamps. Data via the Internet is requested from EGAIS. The application allows you to scan the barcode on the stamp, after which you can immediately report the violation. It also has a map of stores licensed to sell alcohol.

How EGAIS works

All producers and importers of alcohol label each unit of goods (kegs, bottles). The manufacturer glues federal special stamps, and the importer glues excise stamps. A two-dimensional barcode on each bottle contains the name of the alcoholic beverage, manufacturer information, licenses, date of bottling and other unique characteristics.

To meet the technical requirements, each outlet must have a computer with a universal transport module and an Internet connection. When selling alcohol, the cashier reads the barcode from the bottle with a scanner. The store's cash program sends information from the barcode via the Internet to the federal service server for verification. After a successful check, the system generates a unique QR code for the check and the alcohol is released to the buyer. The buyer receives a check with this code (even if he bought several bottles of alcohol, one QR code is printed on the check).

How to check the legality of alcohol

In order to check the legality of the purchased alcoholic beverages in a store, cafe, restaurant, or any other point, you need to install the free Anti-Counterfeit Alco application on your smartphone. The program can be downloaded from the Google Play, App Store, Windows Phone stores.

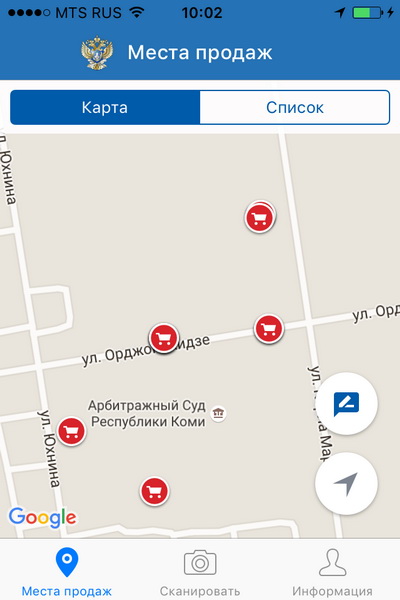

After installing the application on your smartphone, you need to launch it. Then you need to register. A map with legal points of sale of alcohol will appear in the starting window. The map can be transformed into a list with specific locations and geo-referenced to your location.

At the bottom of the screen is the Scan tab. Clicking this tab activates the mobile device's camera. The program will prompt you to point the camera at the barcode of the brand, or the QR code of the receipt, which was transferred to the buyer by the seller. When you point the camera at a barcode or a QR code, information about the product and its path from the manufacturer to the outlet appears on the smartphone screen. If the information is missing, it means that the product is counterfeit.

In the Anti-Counterfeit Alco application, there is a function to notify about an illegal point of sale of alcohol, as well as counterfeit products. To do this, just click on the "Notify" button: a completed form will open with the exact coordinates of the place, to which you can attach a photo and your comment.

Hello dear readers! Today I propose to talk about what counterfeit is, how to deal with it, and how alcohol is checked by an excise stamp.

Did you think that surrogate drinks are protected so reliably that it would be impossible to calculate them with some knowledge? That excise tax can be bought at any Soyuzpechat stall and not be held responsible? We will try to figure out how excise can serve as a guarantee of quality, and how the process of obtaining certification is monitored.

It is believed that the excise stamp was invented by the state solely for the purpose of obtaining a tax on the sale of alcohol, so that the tax can regulate the alcohol market and influence the cost. This is partly true, but a simple distinctive sign can also protect the health of the consumer and warn him against buying low-quality products. To know everything about the excise tax, I will try to describe the main verification methods and the nuances that will show that you have a fake.

How to distinguish a fake yourself

1. Mindfulness

Remember the children's game "Spot the Differences". Picking up a bottle with an alcoholic drink in a supermarket is just the time to remember your powers of observation and see if all the degrees of protection are on the sticker that holds the container and the lid together.

Forgery of any means of protection is a costly business, which is why excise forms often pay attention to the simplest points, while complex levels are ignored. 4 things to pay attention to:

- Brand number applied by inkjet printing;

- Barcode;

- Foil holographic image;

- Data about the manufacturing plant, security level, release date.

2. Scan

If you buy alcohol not in a stall, but in a market that respects its reputation, there must be a special scanner here. He may be waiting for you at the reception desk. It is enough to scan the excise stamp for the electronics to check all levels of compliance. Although according to experts, even with such a check, you will not be given 100% guarantees.

3. Measure seven times

Each excise sticker has its own size. For alcoholic beverages, it is set in two versions: 90×26 and 62×21. If the dimensions do not correspond to those indicated, have uneven or wrinkled edges, you should be wary.

Another nuance is that on a large stamp, the upper part is separated from the larger lower golden thread. It is not erased, does not smear, if necessary, it can be pulled out of the paper.

4. Little tricks

Surrogate alcohol should have a low cost, so it is not in the interests of bootleggers to spend money on fake protection. In order to make it easier for the consumer to bring counterfeit goods to clean water, small fragments that are imperceptible at first glance were invented on protective parcels (stamps).

Knowing about them, it is not difficult to determine the original. These inconspicuous signs of originality include:

- On the top of the text, the word "brand" is written in a negative stripe, and "FMS" in a positive one;

- The diamonds of the hologram contain a pattern with the RF logo woven into it in the central part;

- The stripe with the inscription "Federal Special Stamp" gradually changing colors, passes from a negative print to a positive one;

- The excise paper itself is made in the form of self-adhesive and does not have luminescence;

- Fibers are scattered over the entire surface, they may be non-luminescent red or luminescent yellow-red.

Video instruction

Video instruction on how to distinguish a fake excise stamp from a real one

Checking over the Internet

There are several ways to check liquor protection online.

Last chance

There is another 100% verification option, but relatives or police authorities will rather use it in case of death or alcohol poisoning. This is a forensic examination conducted by the "Center for Forensic Expertise".

Here, the liquid will be decomposed into its components and molecules and it will be found out whether it corresponds to the high name of the ethyl-containing potion or is a fake. Excise duty will also be studied here. They will probably even determine on what equipment it was printed. Only these measures will already be a reaction to the event that we are planning to prevent.

Conclusion

Knowing about the levels of protection for alcoholic beverages and how to check their originality, of course, gives you additional guarantees when buying, but it does not at all insure against costly artful counterfeiting. After all, the stereotype that a surrogate is made only in the form of burnt vodka has long outlived its usefulness, and in our realities, elite, expensive alcohol is of greater interest.

Now you are armed with the necessary knowledge and you have less chance of running into a fake. But still, I highly recommend reading an article about. This is a very terrible poison, the adoption of which in most cases leads to blindness and even to of death. With methyl poisoning, the clock counts, and in order to take the necessary measures, it is extremely important to have the necessary information.

This is where I end. I would like to advise you to buy alcohol only in specialized stores and still pay attention to the excise tax, because it is printed for us! Subscribe to my blog updates, share interesting facts on social networks, and get fresh and reliable first-hand information!

See you soon, Pavel Dorofeev.

For alcohol. It is applied to protect goods of proven quality. Underground manufacturers often forge decals, which causes poisoning. The established authenticity of the sticker guarantees the safety of drinking in moderation.

Purpose of certified marks

To protect citizens from, special stickers are made. They have several degrees of protection:

- high quality paper;

- decals;

- barcode checked online;

- reflective sticker that shimmers in the light.

The use of expensive equipment in the manufacture of high-quality stickers makes it possible to achieve the main goal - the inefficiency of forging excise taxes. It is unprofitable for underground manufacturers to engage in the production of original signs - they will have to fork out for this. Therefore, on the shelves of stores there are alcoholic products certified in accordance with established standards.

People attach little importance to the external signs of clandestine production, consuming poisonous mixtures. But for the safety of the health of loved ones and guests, you need to know how to check the excise stamp for alcohol. There are two ways to determine the quality of alcoholic products:

- visual;

- by number: scanner or on the Internet.

How to visually distinguish the original from the fake?

You can check the authenticity of alcohol by excise stamp by familiarizing yourself with the main features of the original sticker:

- the edges of the label are even, the pattern is streak-free;

- on the reverse side there is a luminescent inscription "Alcoholic products";

- with a magnifying glass you can see the words “brand” and “FSM”, the colors of the inscriptions are shown inversely;

- there is a holographic sticker on the excise tax;

- there are two blue squares glowing under the fluorescent lamp.

The question of how to check the excise stamp for alcohol is treated without due attention. People believe that counterfeit is cleaner than the original drink in terms of composition. However, official statistics cite cases of severe poisoning when people die during holiday feasts. Unknown substances in the base cause liver damage, loss of visual acuity, hearing.

Additional verification methods

You can check the excise stamp for alcohol by number right in the store by typing the number into your smartphone browser. For such purposes, the official website - service.fsrar.ru is intended. There are applications for the Android system that offer to scan a barcode using a camera.

How to check the excise stamp for alcohol, the employee of the relevant department in the supermarket will tell you. It can scan the barcode of the label and display the information on the display of the device. But this method does not always become a reliable sign of the quality of alcohol. It is required to take into account all the degrees of protection listed in the article.

The unified state automated information system allows you to check any excise stamp in the Unified State Automated Information System. The database stores information about the manufacturer of the product, its movement and the retail point of sale. By checking the brand in the Unified State Automated Information System, you can verify the legality of the purchased alcohol.

- EGAIS

- EGAIS Alcohol

- EGAIS Beer

- EGAIS Retail Sales

- EGAIS Wood

- EDS for EGAIS

- EGAIS website

- EGAIS accounting

- EGAIS in 1C

- EGAIS connection

- EGAIS Alcohol

Have questions about EGAIS?

Leave your phone number and our specialists will call you back within a few minutes!

Do you know that it is possible to check the excise stamp of any manufacturer and importer in the Unified State Automated Information System (EGAIS)? The database stores information about the manufacturer of the product, its movement and the retail point of sale. By checking the brand in the Unified State Automated Information System, you can verify the legality of the purchased alcohol. It sounds simple and clear, but we will now find out how to do this and what are the verification mechanisms.

What is a tax stamp

An excise stamp is a fiscal package that confirms the payment of excise duty and the legality of the product. Today's EGAIS brand is also a carrier of important information about the manufacturer. It helps to control the turnover of alcoholic products, being a source of data for the Federal Service of Rosalkogolregulirovanie (FS RAR), wholesalers and consumers.

Step-by-step instructions for checking alcohol in EGAIS

Licensed market participants, wholesalers and retailers can check alcoholic products. Employees of authorized regulatory bodies also have access to the database. To check alcohol in EGAIS, you need to perform a number of actions.

As a result of the check, a new line will appear in the column with the following information:

- Name of product;

- details of the manufacturer or importer who received the excise stamp;

- license data;

- date of bottling of the drink and other unique characteristics of the product.

The data provided by the database can be printed by clicking on the "Print" button.

Attention! In order to check the brand in EGAIS, you will need a computer with the appropriate software connected to the Internet, a JaCarta crypto key with a qualified signature, and a barcode scanner.

From the moment of production to the sale to the end consumer, alcoholic products are checked by the barcode several times. The first is carried out by the storekeeper of the wholesale warehouse, if the goods do not arrive immediately at retail. Then the alcohol is checked by the receptionist of the retail store or catering enterprise, processing the supplier's invoices in the EGAIS system. The last inevitable check occurs at the checkout, when the cashier releases the item to the customer and scans the barcode. During this procedure, there is an automatic exchange of data with the PAP server, which confirms the sale. The system generates a unique QR code for the cash receipt. After that, technically, a bottle of alcohol can be tested again if the buyer decides to make sure the product is legal.

Checking alcohol from a smartphone

On July 1, 2016, the RAR FS launched the Anti-Counterfeit Alco application for smartphones running on Android, Windows Phone and iOS. Thanks to this program, everyone can check alcohol online in the Unified State Automated Information System for authenticity and find out points of sale of legal alcoholic beverages. The app can be downloaded from Google Play, Windows Phone, and the App Store. The program can read the barcode located on the bottle and QR codes from checks issued at the checkout.

To test alcohol, follow these steps

Install the program on your smartphone and launch the application

Point your device camera at a barcode or QR code

Click on the "Scan" button

As a result of the actions performed, information about the product and its path from the manufacturer to the point of sale should appear on the screen. If it is missing, then the product is counterfeit. After detecting illegal alcohol, the program offers to report a violation. Click the "Notify" button, specify the exact coordinates, and, if desired, supplement the information with photos and comments.

Notable in the application and work with the map. On the start page, the user has access to information about all official places of sale of alcoholic beverages (shops, restaurants and cafes) with reference to his location. The map is tied geographically and works.

Remember! The Anti-Counterfeit Alco smartphone application, which allows you to check alcohol by excise stamp online in EGAIS, is free. Install the program only from the official sites listed above.

Why you need to scan tax stamps

Does your organization use linear barcodes or tax stamp data for internal movement and inventory? You think it doesn't matter, so you act in the usual way?

Remember how many products can have the same name, and how many of them are visually identical and differ only in the name of the manufacturer? And there are also cases when the same product is from one supplier, but depending on the batch it has a different alcocode. This code cannot be determined by a regular barcode, you must scan the excise stamp.

Due to non-use of individual alcohol codes when accounting, an enterprise may receive a re-sorting, which will be difficult to understand. For example, let's take several bottles of vodka from the same manufacturer, but in different batches, and also take into account the fact that a couple of bottles from last year were lying around in our showcase. Thus, we can get three different alcocodes and only one regular barcode.

From the point of view of the system, if the EGAIS excise stamp is different, then we have a different product, although it looks exactly the same outwardly. As a result of the store’s operation, goods will accumulate on one alcocode, and on the other they will go into negative territory, due to which the balances according to the EGAIS will not match the actual ones, and this can already lead to a fine, although it is still permissible to regulate the balances by drawing up acts in the program. But the larger your assortment, the more difficult it is to keep track of the reasons for the identified resorting.

That is why it is necessary to check the excise stamp of alcohol in the Unified State Automated Information System not only during the inventory, but during any actions with the goods.

Order an EDS for EGAIS and use the excise stamp verification service at any convenient time!

Just about EGAIS

Find answers to all your software questions

Astral products and services in our knowledge base!

Office hours:

Monday - Thursday from 9.00 to 18.00 (without lunch)

Friday and pre-holiday days from 9.00 to 16.45