How to find out your Sberbank plastic card account. What is a Sberbank card personal account? Visit the Sberbank branch that issued the card.

Any Sberbank card has two numbers - the one indicated on the “plastic” itself, and the personal or current account number specified in the agreement. During the validity period of the card product, both of them are used by the client to perform various transactions. For information on how to find out your Sberbank card account, read the article.

Methods for obtaining information about a card’s personal account may be different:

- View the agreement for servicing a bank card or the cardholder's application.

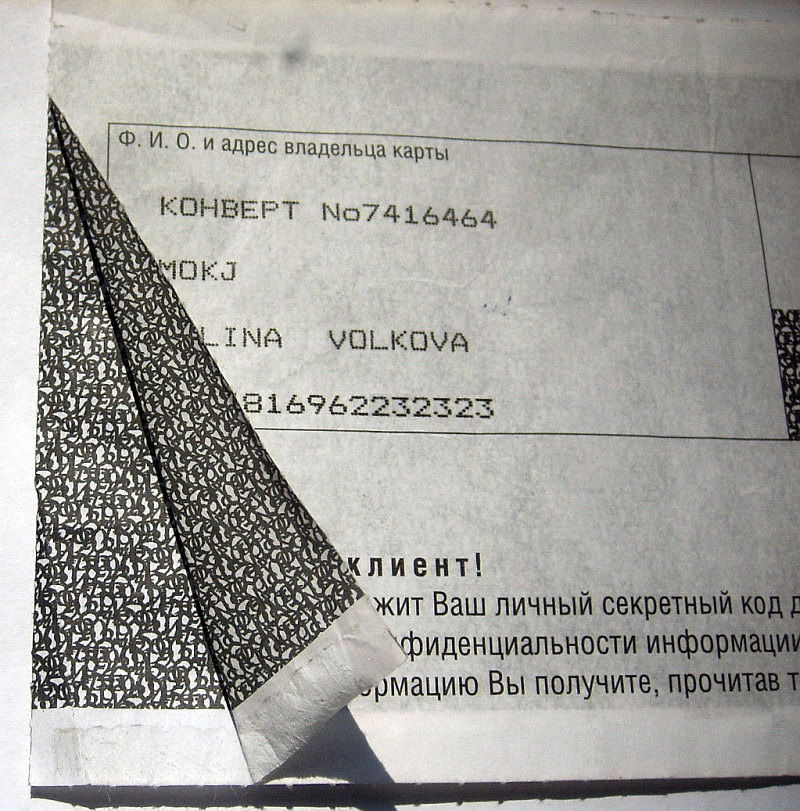

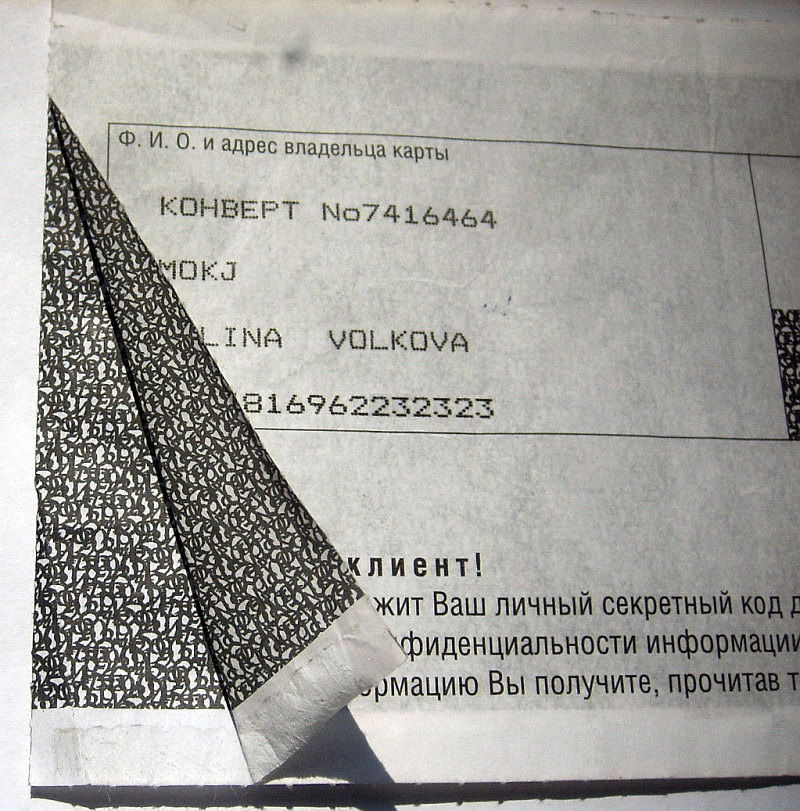

- Pay attention to the PIN envelope that every owner of this banking product has. On the inside are the holder's full name, a unique code for making transactions on the card and a 20-digit account number.

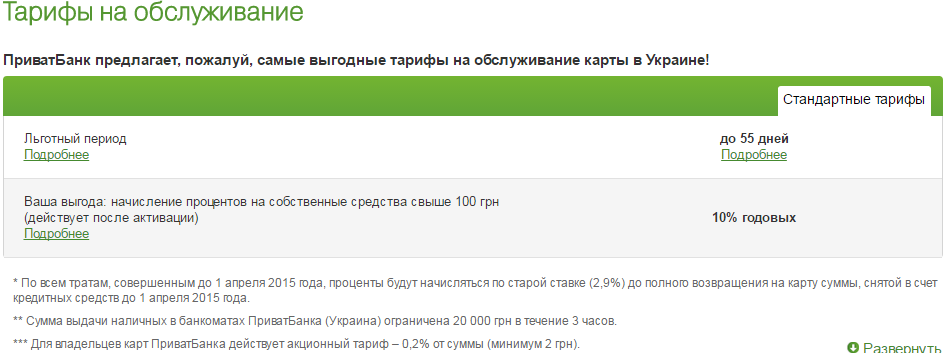

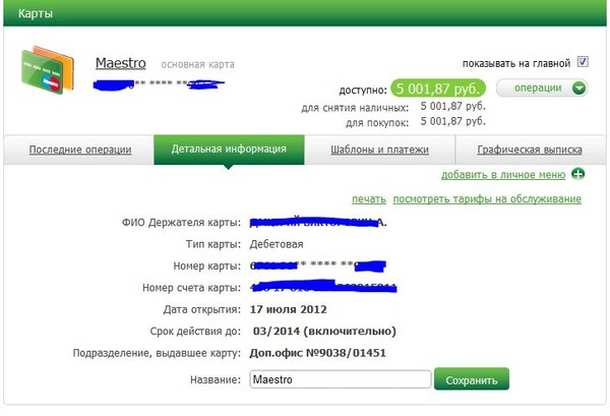

- Go to the Sberbank Online service in the “Cards” menu item.

- Contact the Sberbank call center for help by calling 8 800 555 555 0. The operator will provide the necessary information only after verifying the identity of the caller. The card holder provides information about its number, names the code word, full name and date of birth.

- Contact a bank operator or consultant with your passport and plastic card. At the client's request, an official certificate will be issued to him indicating all the bank details and the card's current account number. Such a document is provided to any institution that transfers funds to the client’s card.

To record card transactions, two types of accounts are used - personal and settlement. The first one is opened for cards of individuals. The second one only has corporate cards. Those who have entered into a universal banking service agreement can find out their Sberbank card account via the Internet. For this purpose, the client is provided with the capabilities of the Sberbank Business Online resource. In addition, the number you are interested in can be obtained from the manager of the department for servicing legal entities.

- Log in to your Sberbank Online Personal Account using your user IDs. To receive them, just go to the bank’s transaction window with your passport and card. They are also available at the ATM in the “Sberbank Online” menu item.

- Open the “Maps” menu item.

- From the list of cards, select the one by which the client wants to find out the number personal account.

- Click “Map Information”. The window that opens shows the cardholder's full name, account number starting with 40817, 40820, 42301 or 42601 and having 20 digits, and the account balance at the current time.

- Full bank details and service rates are available at this point.

A plastic card number, consisting of 16 or 18 digits, is used by cardholders much more often than the Sberbank card account number. How to find out your personal account is described above. What might it be needed for?

It is necessary for transferring funds both within Sberbank and from other credit institutions. Upon admission to work, it is provided to the accounting department of the enterprise for the transfer of wages. All transactions made by the client using the card are reflected on the personal account the next day. In case of loss or damage to the “plastic”, the client can withdraw money from the account at any time in the bank’s transaction window.

- All cardholders are advised to periodically check their personal account statements for illegal card transactions. Get printouts at the bank office or at Sberbank Online.

- When conducting card transactions, you must save all receipts. If you are in doubt about any amounts, you should contact the bank.

It's no secret that receiving a bank card means automatically opening a bank account. Consequently, this account has its own unique number, which the card owner may need in order to transfer funds or block the card if it is lost.

However, the combination of numbers that the card holder can see on it front side– this is the number of the card itself, not its account. As for the account number, there are several ways to establish it.

Basic ways to establish a card account number

The card account is usually indicated by a 20-digit code and is most often indicated in the service agreement or application form. However, recently, in order to increase the security of customer accounts from various types of fraudulent activities, Sberbank employees have stopped including these important figures in contracts. However, you can find out your account number if necessary in several simple ways.

Envelope from the bank

When issuing a plastic card, Sberbank specialists hand over to their clients sealed envelopes containing strictly confidential information: a PIN code for checking the balance of funds via the Internet and the bank account number itself.

When issuing a plastic card, Sberbank specialists hand over to their clients sealed envelopes containing strictly confidential information: a PIN code for checking the balance of funds via the Internet and the bank account number itself.

Office visit

If a client needs to find out the account of his card, then he can safely go to the branch where it was issued. You will have to take with you a passport or other document with a personal photo and the card itself.

Making a call to Sberbank

Sberbank of Russia operates a 24-hour direct number to which the client can make a free call and find out the card account number.

To do this, dial the number 8-800-555-555-0, wait for the operator’s response and tell him your full name, date of birth and card number indicated on its front side.

You will also have to remember the secret code word that each bank client receives when issuing a card. The operator will then find the account number corresponding to this data in the database.

Using a virtual service

For many years, clients of Sberbank of Russia have been served not only in person, but also through the electronic service “Sberbank Online”. A client wishing to find out the card number must register with Mobile banking, which can be done at any branch of a financial institution or through an ATM, and then enter your password and login into the form provided on the official website of Sberbank. After logging into your personal account, the user will only have to go to the “Cards” section and look at his account number there. The registration process at Sberbank online.

Self-service channels

For Sberbank, as for other financial and credit institutions, these are ATMs and terminals. The cardholder simply needs to carry out any operation through the ATM - and the account number will appear on the display.

Why do you need a card account number?

When carrying out regular transactions through an ATM, the cardholder may not think about her account. However, when it comes to implementation money transfers this information can be extremely useful. A bank card account allows you to carry out the following operations:

When carrying out regular transactions through an ATM, the cardholder may not think about her account. However, when it comes to implementation money transfers this information can be extremely useful. A bank card account allows you to carry out the following operations:

- Pay utility bills;

- Implement interbank transfers;

- Receive funds onto your card from abroad.

Thus, finding out the card account number for Sberbank of the Russian Federation products is quick and not difficult. Any cardholder can find out his account in a way convenient for him by phone, via the Internet, an ATM, or by visiting a branch of a financial institution.

If you are the holder of a Sberbank card, then you probably have a question about how to find out the account number of a Sberbank card. This question usually arises when you need to transfer funds to a card or receive any payment.

Do not confuse the card account with the card number, which is located on the front side of its plastic carrier; it consists of 16 or 18 digits.

Typically, the account number, along with bank details, is used when transferring money by various organizations, for example, when calculating wages. If you want to make it simple, you only need a Sberbank plastic card number.

So, you can find out the Sberbank card account number in several ways:

- The account number, as well as the card number, are indicated in the envelope with which you were provided with the plastic card. If you saved this envelope, look into it and your issue is resolved.

- You can also find the account number in the agreement that you entered into when you received the card. This is not always possible, because in addition to the account number, it also contains bank details, card number and much other information, which can sometimes be difficult to understand.

- You can present your ID to any Sberbank branch nearest to you, where an employee will provide information about your account.

- You can also ask for help by phone. Sberbank hotline – 8 800 555 5550. Prepare in advance, because the bank employee will need to tell you your details, your card number, as well as the code word specified in the agreement. If you do not remember the code word, then you will have to indicate the series of your passport. After checking the data, the operator will dictate your account number over the phone.

- A very convenient way - . All you need to do is log in to the system using your username and password, and in the “cards” section you will find all the information you need.

Choose the most convenient and accessible method for you, find out the 20-digit account number, and you can safely carry out all the operations you need with your card.

Plastic cards are so necessary for people that almost everyone has them. However, as you use them, questions often arise. One of the most common is about the account number. It is not printed on the means of payment and sometimes this greatly complicates the life of clients. How to find out the account number of a Sberbank card if it is opened simultaneously with the issuance of the card and is not always announced to people? Everything is credited to it cash: wage, scholarship, pension, contributions and transfers. What methods should I use?

What is a personal account

This is an accounting system that reflects the monetary relationship between an individual and a bank: deposits, accrued interest, expenses. The information is strictly confidential - by law it is issued only to regulatory authorities upon their request. A personal account is 20 digits that are not similar to the numbering on the card. The latter changes with each re-release, but the score always remains the same.

There are certain rules of the Central Bank. According to them, accounts of individuals begin with certain numbers, for example, with “40820”, “42601”, “40817”. The next 2 digits indicate the currency code, the 9th indicates the bank itself, the 10th to 13th digits indicate a division of the financial institution, and the last 7 are the individual client number.

What is the difference between a current and personal account

The main difference between them is that the personal account is a bank account individual(taxpayer), and settlement - legal. The checking account is not used for savings or for the purpose of passive income. Legal entities need it for quick and reliable access to their finances via the Internet or a personal visit. Clients can deposit any amount and withdraw their money upon request. One person can open several accounts.

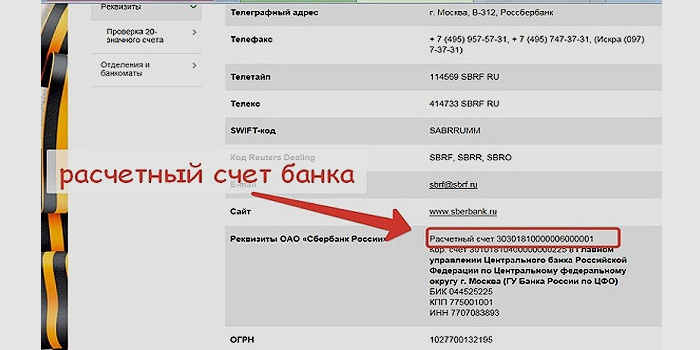

Another type of bank account is a correspondent account. It and the BIC are sometimes necessary to know in order to transfer money to an organization. A correspondent account is needed for internal bank transactions and direct settlements with other financial organizations. Not used by private individuals. This account consists of 20 digits, with the same beginning for everyone - 301, and the last 3 duplicate 7-9 digits of the BIC.

Ways to check the account number of a Sberbank card

How can I find out my personal account number? This is the main detail that will be needed to make payments and various types of transfers. It is worth reading in more detail about what bank card details are. As noted above, you won't be able to recognize them just by looking at your card. However there are several available ways obtain the necessary information. We will describe in more detail how to find out the account number of a Sberbank plastic card.

In an envelope with a PIN code

Often bank card issued together with a special paper envelope. There is also a PIN code inside. The account number is printed on the front. The issued envelope is black and white, impersonal - without the logo and name of the organization. Due to its unremarkable appearance, it is very easy to lose or throw away. The number we are interested in is easily recognizable - it is long, has at least 20 digits. If the paper envelope is saved, there should be no questions about how to find out the current account.

At a bank branch

People go to a bank branch not only to apply for banking products, obtain a loan, make statements, enter into contracts, replenish the balance or change a payment card. They are also visited for additional consultation. If you cannot find out the account number in any other way, you should contact bank employees for help. You must take your passport with you. All details will be printed out for you, including the required number. The only drawback of this method is that you need to spend time on the road.

In a questionnaire or contract

When applying for a card in Russia, clients always sign an agreement on opening and maintaining an account. One copy remains with the financial institution, the other with the individual. IN this document The 20-digit account number is always indicated. This is exactly what is needed for conducting monetary transactions. Sometimes the invoice is entered in the loan recipient’s application form, for example, or in the application for a card.

By phone or email

One of the quickest ways to find out any information is to call the support service. To obtain information, you should prepare your passport in advance and remember the code word. If the client has forgotten the security answer, employees hotline will not help, since the information about the account is closed. However, you can get information from them on how to find out the account number of a Sberbank plastic card in other ways, how to view card details in Sberbank online.

The official website provides a feedback form, which is also worth using. To receive a prompt response, you need to describe the problem in detail, indicate your region and correctly formulate the topic. After clicking the “Next” button, you need to make sure that the application has been sent. After that, you just have to wait for an answer.

Via the Internet using an online service

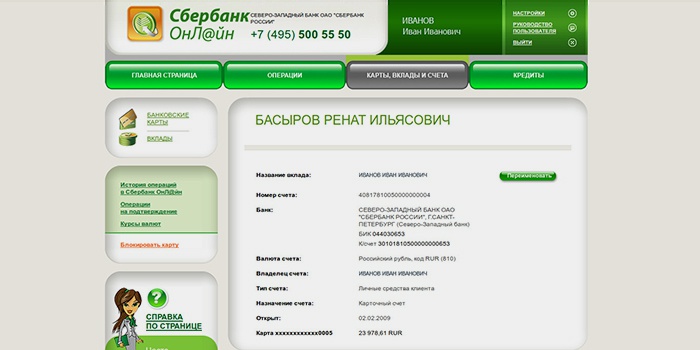

How to find out Sberbank card details on the Internet? Registered users of Sberbank Online have the opportunity to perform many operations independently: order details, make transfers, control enrollments, find out official exchange rates, receive the necessary information on a plastic card. To use the service you need to create account. Next steps:

- log into the program using your login and password;

- enter the one-time password sent by message to your phone;

- go to the “Maps” section and click on the desired option (if there are several cards);

- find the “Information” tab and find your number in the “General Information” section.

The online service allows you to perform operations around the clock, regardless of the day of the week or date. The bank client does not have to travel anywhere, sit in line or communicate with strangers. Operations are carried out almost instantly. The most important thing is that the services are free. If you encounter any difficulties while working, we recommend watching a video on how to find out your account on a Sberbank card.

Via ATM or terminal

If you know what card details are, use remote self-service channels from time to time and have an idea of what they look like, this method is suitable for you. It is convenient to use it abroad, where there are no bank branches. To find out your bank details, you need to:

- insert the card into the device;

- dial your PIN code;

- V personal account find the “Information” window, then “Service”;

- Click on the “Screenshot” button to get the full data (they appear on the screen).

Video: how to get the details of your Sberbank card

The video describes in detail how to find out your details and SWIFT code in the Sberbank Online program. The first information is required for domestic transfers, the second – for international transfers. Before making currency transfers, the speaker strongly recommends checking with your bank branch to see if they accept them. Small units may not do this.