How to calculate income and expenses

Country support:

operating system:Windows

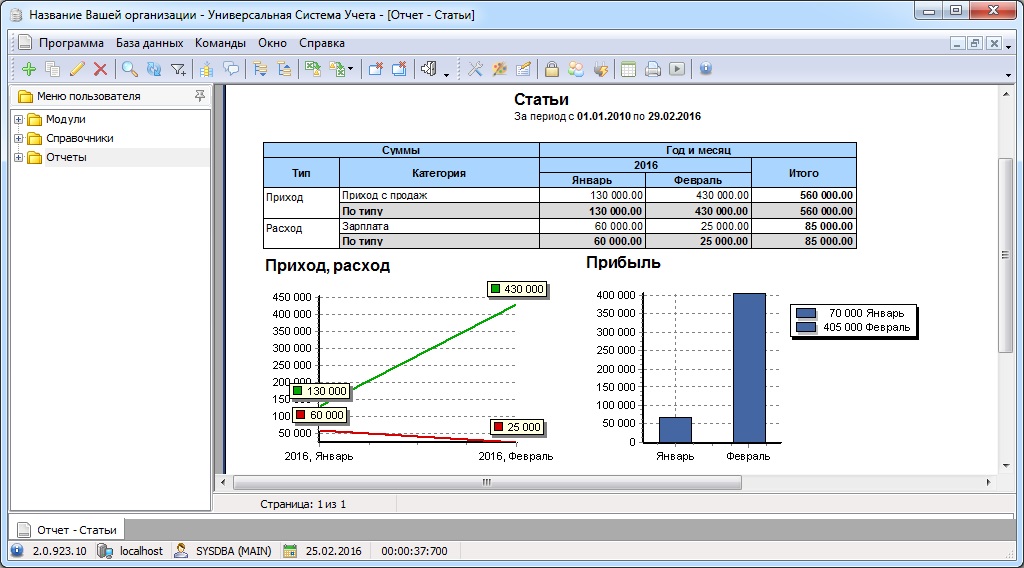

Family: Universal Accounting System

Purpose: Business automation

Calculation of income and expenses

Main features of the program:

We have completed business automation for many organizations:

Language of the basic version of the program: RUSSIAN

You can also order an international version of the program, into which you can enter information in ANY LANGUAGE of the world. You can even easily translate the interface yourself, since all the names will be placed in a separate text file.

To calculate income and expenses, you can, of course, use many different methods, methods and tools, but truly effective means not so much. In order to efficiently and quickly calculate income and expenses, you need a multifunctional and competent software tool. We offer you a program for automating accounting, including calculating income minus expenses - the Universal Accounting System will make the work of all employees of your company easier.

Calculation of income and expenses of the organization in information system USU occurs practically without user participation. The main task of an administrator or other employee is to enter current data. In addition, the program for calculating the budget, income and expenses greatly facilitates work due to the fact that most of documents can be created and filled out automatically - all you have to do is print them required document and enter the missing data.

The USU company management will also bring a lot of undeniable advantages and conveniences in managing processes that are not even related to the calculation of income and expenses of the enterprise. The table for calculating income and expenses allows you to skillfully manipulate data, create reports on one or another aspect of activity, and calculate the plan for income and expenses. Here, with the help of built-in tools, you can easily predict the income, expenses of the enterprise, calculate profits and other important indicators. Accounting for project income and expenses will be as clear as possible, which makes it possible not only to easily perceive the information, but also to track trends.

Calculation of family income and expenses can also be done in the Universal Accounting System. The calculation of upcoming income and expenses is based on information for previous periods. The program for calculating expenses and income has an intuitive interface and is very easy to learn, and it is very easy to use on a daily basis. Program for calculating income and expenses investment project available for trial use in a free demo version on the website.

The monitoring and control program can be used by:

- Any government company;

- Private company;

- Individual entrepreneur;

- Self employed;

- and so on.

Video programs for calculating income

By watching the following video, you can quickly familiarize yourself with the capabilities of the USU program - the Universal Accounting System. If you do not see the video uploaded to YouTube, be sure to write to us, we will find another way to show the demo video!

Possibilities for monitoring and managing cost calculations

- The USU program will help you organize the calculation of income and expenses in your enterprise;

- The system for calculating income minus expenses will provide invaluable assistance in creating a successful image of your business;

- Tracking employee work and progress on each individual task has become much easier, and this has a beneficial effect on productivity;

- Each transaction made in the program for calculating income and expenses is recorded and remains in the database until the moment you decide to delete it. This allows you to access earlier records if necessary - to do this you just need to use the search and display records for a specific date or period;

- Motion tracking cash flows with the program, income and expenses will no longer be a problem;

- A well-thought-out system of alerts and notifications in the program for calculating income minus expenses will promptly warn each employee about what he must do and by when;

- The interface includes a variety of design themes that make working in the USU even more comfortable;

- To each of the operations performed, you can easily attach scanned documents, photographs or other files that may be needed later when working - this is very convenient, since all the necessary data will always be at hand;

- The management system for calculating income and expenses helps in controlling all organizational processes related to the production and operation of the enterprise;

- The search can be performed using several parameters simultaneously;

- A convenient navigation system allows you to work in the system many times faster;

- The demo version of the USU program is available for download absolutely free of charge;

- Work with each USU client is carried out individually - you can always contact us for help or improvements;

- There is a highly qualified, prompt support service;

- Try USU to calculate income and expenses to stay ahead of your competitors and make your business even better!

Download software for calculating income

Below are the download links. You can download the presentation for free software in PowerPoint format and demo version. Moreover, the demo version has certain limitations: in terms of use time and functionality.

Almost all people periodically experience financial difficulties, especially at the end of the month. There is also not enough money if a person spends what he earns thoughtlessly and does not keep track of his income and expenses, i.e. does not maintain personal accounting. Can accounting for income and expenses help stabilize the situation and how to correctly calculate income and expenses?

Income is the totality of absolutely all cash receipts for the month. If this is a large family, then it is necessary to include the parents’ salary, the grandmother’s pension, and the daughter’s scholarship. And also any social benefits, payments for part-time work at a non-main place of work, etc. Let’s assume that a family has a stable income of 50,000 rubles per month. This amount will be the maximum that the family must pay at the end of the month when it calculates its expenses.

- Payment for public utilities;

- Purchasing travel tickets;

- Payment for telephones;

- Loan fee;

- Tuition fees;

- Nutrition.

This is the main list of payments within which the family will feel comfortable without getting into a hole of debt. For each family, the basic list can be completely different. Having estimated that these vital things will require, for example, 35,000 rubles, they need to be subtracted from 50,000 rubles. You can plan to spend the difference of 15,000 on entertainment, buying clothes, traveling, etc.

- Balanced - income and expenses are equal;

- Deficit - expenses are greater than income;

- Surplus—income is greater than expenses.

The best one will be when income exceeds expenses. There is always somewhere to invest extra money, and it can become a real lifesaver, for example, during an unexpected illness of a relative.

Whether you have a large family or a man living alone, you must count your income and expenses. It is personal accounting that will help you plan large purchases, vacations at sea and will be an excellent incentive in the pursuit of a better life.

Surely every family in our country dreams of bringing some idea to life.

However, few people know that for this you need to control your costs so that you can try to reduce them when necessary. Moreover, there are even programs for this.

For this reason, let's talk about the distribution of the family budget in more detail.

How to make a table and distribute the budget in it

In control income and expenses families use the option with a table in Excel. This is very convenient, because by downloading this document you can easily see:

In control income and expenses families use the option with a table in Excel. This is very convenient, because by downloading this document you can easily see:

- monthly income families;

- expected(which will be spent, for example, on utilities) expenses and actual(these may be types of expenses that are not planned: for any event, urgent repairs and so on);

- difference in income and expenses over the past month.

In simple terms, using this table you can adjust the difference and thereby not go into the minus.

In order not to create confusion with formulas for calculations, it is recommended to download a ready-made table (links below) and adjust it to suit your family budget.

It is necessary to take into account the fact that Excel provides the ability to create a table for family money control, so it is enough to download a ready-made template.

To create a table, you need:

- Download Excel.

- In the upper left corner, select “Create” from the menu.

- After this, you should go to the “Budgets” subsection.

- In this subcategory, select the “Family Budget” tab.

After selecting the last tab, a wide selection of ready-made templates appears on the screen. Just choose the one that suits your family and download it.

After all the operations have been completed, as well as possibly filling in your data, you should get something like this table (again, it all depends on which one the family chooses):

You can also choose this:

By and large, all such tables for monitoring the family budget work according to the same algorithm.

At the beginning of each month, planned expenses are recorded, and at the end of the current month, actual expenses are entered.

As can be seen from the tables, there must be a column with a difference. It indicates the family as a “plus” or as a “minus”. By and large, the structure as in the pictures is present in all ready-made templates, so there are no problems with this.

Programs

Today, there are many paid and free programs that allow you to monitor family income and expenses.

Today, there are many paid and free programs that allow you to monitor family income and expenses.

Paid

Today there are several paid programs, which allow you to control the family budget, namely:

- AceMoney;

- Family

AceMoney

First of all, you need to pay attention to the fact that The cost of this program is about 500 rubles(free use option is allowed, but in the free version there is only 1 account, which is very inconvenient).

If we talk about the disadvantages of this program, then there is only one, but it is significant - there is no way to separate expenses and profit itself, and only one function is available - financial transactions.

If we talk about the advantages of this utility, they are as follows:

- it is possible to take into account various shares or other securities;

- there are separate columns for expenses such as payments for: television, food, utilities (for each service separately), etc.;

- It is possible to enter information about what deposits are available and at what interest rates. At the same time, the program calculates interest on these deposits on a monthly basis.

With this program you can easily understand how to properly manage your budget.

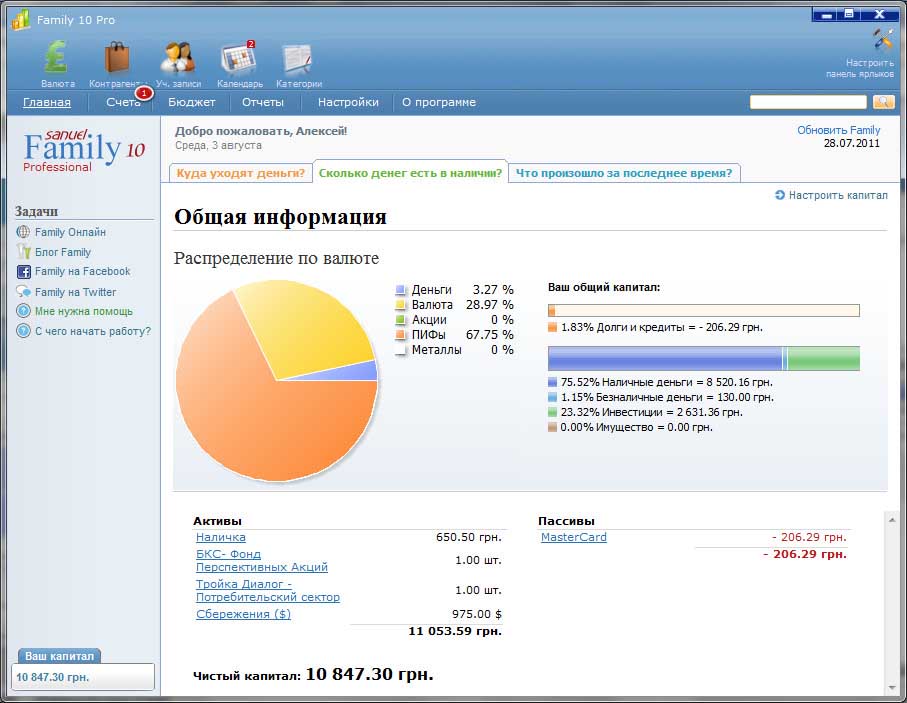

Family 10

This utility will make it clear from the first minutes of its use that it is committed to a mutually beneficial relationship. In simple words it includes a convenient and intuitive interface that any family member can easily understand.

This utility will make it clear from the first minutes of its use that it is committed to a mutually beneficial relationship. In simple words it includes a convenient and intuitive interface that any family member can easily understand.

The functionality of the program allows you to conduct accounting for almost everything that can be found in a family’s home.

Please note that there is no fee for the first month of use, but from the second month you will need to pay about 20 dollars.

Free

TO free programs can be attributed:

- DomFin;

- Money Tracker.

DomFin

This utility includes a rather primitive interface that has specific functionality for excellent control over your family budget. Thanks to this interface, you can easily indicate current income and expenses, calculate the difference.

“DomFin” contains only those terms that will be understandable to every family member who even understands absolutely nothing about managing accounting. From the first days of use, the program is completely free.

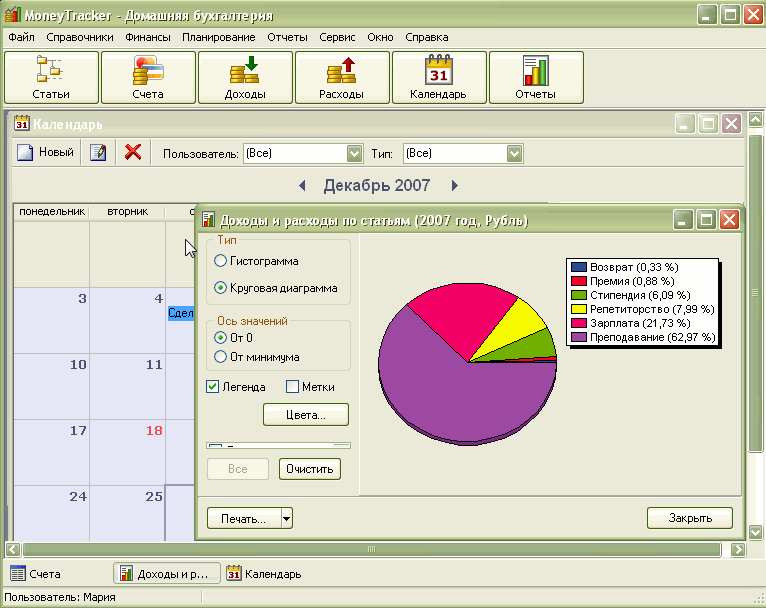

Money Tracker

By and large, the program is fully thought out for the successful implementation of your funds. However, it is still worth getting used to it.

By and large, the program is fully thought out for the successful implementation of your funds. However, it is still worth getting used to it.

Many of our fellow citizens who use this program at home note that it contains many functions that can affect the effective and quick accounting of their income and expenses.

Moreover, if you do not study the program in full, you may even think that many of the functions are useless.

However, it is necessary to note a small positive nuance in this program. This concerns the ability to indicate changes in prices in supermarkets, as well as forecast your budget several months in advance, or even, if desired, you can forecast it for the whole year.

The program provides several color alert options. If it lights up green color– the difference between expenses and income is acceptable, with yellow color– it’s worth thinking about reducing costs, but if it’s red, it’s urgent to reduce financial costs.

Example of a finished table in Excel

In order to better understand which table is needed for a particular family, it is recommended to look at samples of ready-made tables:

If desired, any of these tables can be used to monitor your family budget.

Having analyzed many reviews from our citizens on the Internet, we can highlight the main tips provided by these users for those who are just starting to control their family budget.

So, tips for managing a family budget look like this:

So, tips for managing a family budget look like this:

- First of all, you should learn to understand the meaning of how to plan a budget, Why do you need to control your funds?. An example of this could be the desire to reduce the amount of monthly expenses by 10-15% in order to save up for renovations in the apartment or to achieve another goal. If you approach this matter because “everyone does it this way,” nothing will work out.

- When creating a table with your personal budget don't overload it small details . Only the main points need to be indicated in this table. In particular, you can indicate costs for: food, utilities, clothing, entertainment, and so on. You shouldn’t write that “I only bought sausage today - 400 rubles.” It is also always worth paying attention to time to enter data into the table– with prolonged attention, she will quickly get bored and then any desire to control expenses will disappear. You need to work with the table according to the principle: “Brevity is the sister of talent.”

- Savings can only be made with any major purchases. As a rule, there is no need to try to save on small things - it is useless. For this advice there is no suitable folk wisdom, which reads - “After drinking on vodka, you can’t save money on buying matches” . This rule must always be remembered and then you can achieve certain successes. What does this mean? It’s simple - you need to analyze those columns where the percentage of waste is the highest, and try to reduce this percentage a little. We can say that by saving 10%, there is a 40% chance of making a profit.

- If possible, then it would be best to open a bank account, which should serve as a savings account. All cash, which were saved after the current month, will need to be transferred to this account.

- It is always necessary to remember that all the goals set, because of which, in fact, the family budget is controlled, must be achievable. In the first stages, you should pay attention to the fact that it will be very difficult, but only after the family is able to cope with this will it be possible to see firsthand the results of monitoring the family budget.

- If a situation arises when it becomes clear that it is impossible to do without revising the family budget, or rather spending it, everything must be done to reduce your financial costs. Many families are afraid of changes in this and prefer to stay with this control. Or rather, give up control of your finances and live as before. However, to achieve your goals, you cannot do without revising your budget expenses.